Jehoshaphat Research is short Amdocs Limited (NASDAQ:DOX). Q4 2020 hedge fund letters, conferences and more Today, we reveal the results of a months-long investigation into what we believe is a massive financial deception taking place at Amdocs (DOX). The information we are revealing has never before been seen by investors. We have gathered extensive evidence […]

Free Book Preview

Money-Smart Solopreneur

This book gives you the essential guide for easy-to-follow tips and strategies to create more financial success.

March

31, 2021

8 min read

This story originally appeared on ValueWalk

Jehoshaphat Research is short Amdocs Limited (NASDAQ:DOX).

Q4 2020 hedge fund letters, conferences and more

Today, we reveal the results of a months-long investigation into what we believe is a massive financial deception taking place at Amdocs (DOX). The information we are revealing has never before been seen by investors.

We have gathered extensive evidence from the national corporate registry filings of dozens of subsidiaries from around the globe, which we then compared to DOX’s public filings. We found wildly overstated profit margins, a balance sheet that is far from the cash-rich fortress it appears to be, and a revolving door of company auditors resigning from their posts in multiple countries. These enormous discrepancies between DOX’s true business health and the mirage that is its reported finances simply do not reconcile.

We have alerted DOX’s auditors, the press, and others who will be interested in these discoveries. We are available at info@jehoshaphatresearch.com for questions.

In our view, this stock is uninvestable.

Executive Summary: Amdocs’ Profits Overstated by ~40-50% as Subsidiaries Have Irreconcilable Differences With Parent:

- Using Amdocs’ international subsidiary filings, we have uncovered an ugly truth: DOX’s operating profitability appears to be overstated by ~40-50%, or as much as $200m.

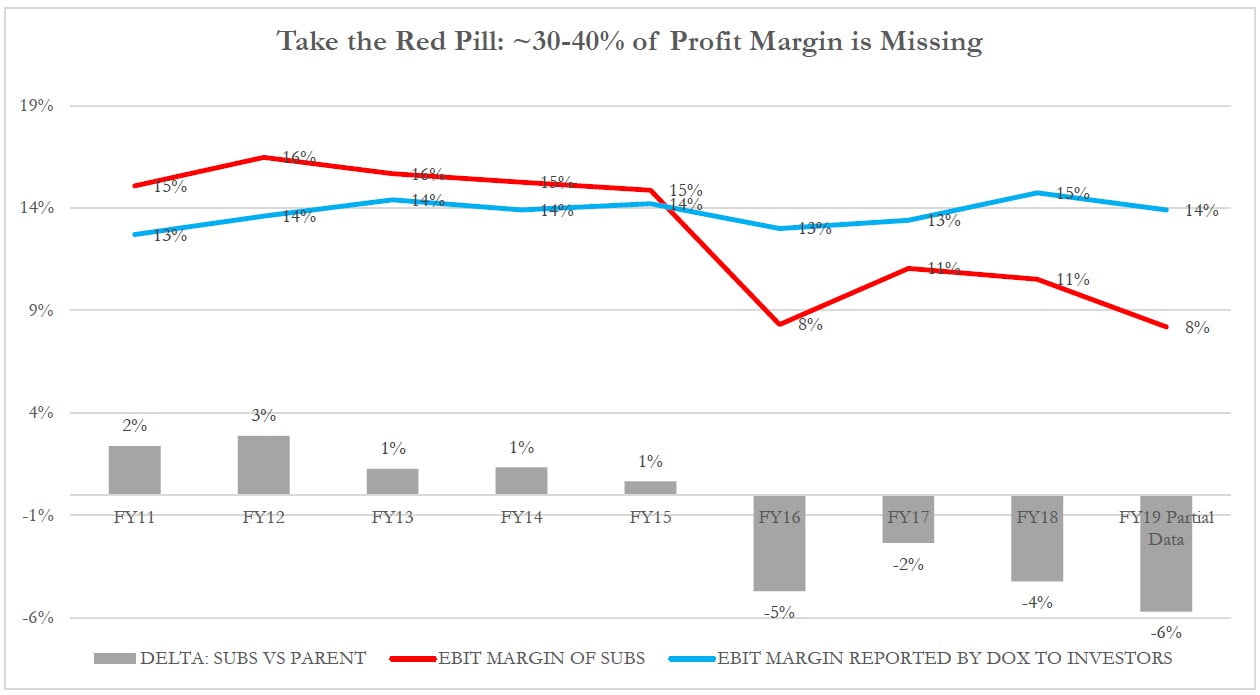

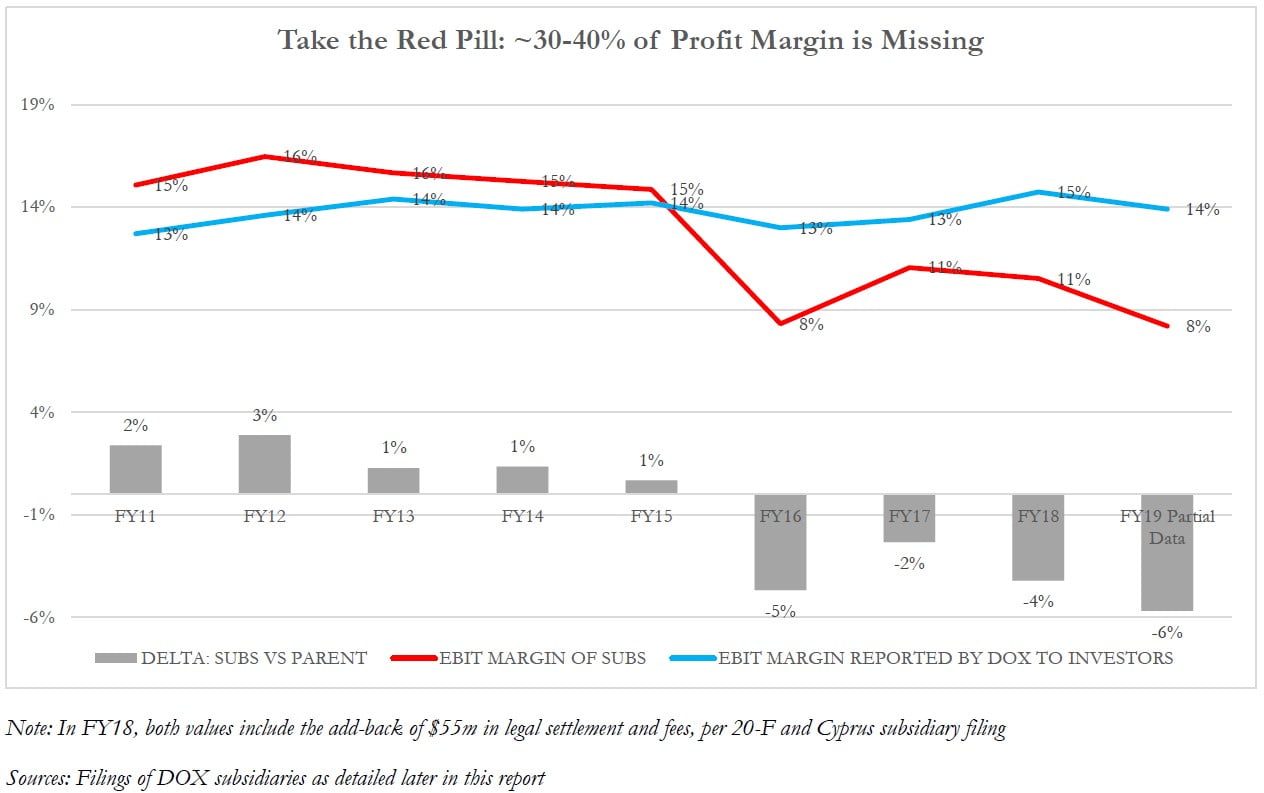

- Years ago, DOX’s major and minor corporate subsidiaries had profit margins that reconciled reasonably closely with the profit margins reported by the public company parent. However, beginning in FY16, sub profits began to exhibit a sharp decline…but DOX continued to report steady, healthy profit margins at the parent level.

- Numerous accounting “red flags” started appearing more visibly in the parent financials around the same time as this breakdown, and some of these corroborate our findings. Serious investors should already be familiar with these items: unbilled DSOs, bad debt allowance games, reserve releases, etc. But this report is not about those red flags.

- DOX’s true margin from its subsidiaries, which our work uncovers, is consistent with its BPO (Business Process Outsourcing) business model. The public company financials betray the truth, which is a BPOtype, single-digit EBIT margin.

- DOX’s cash tax payments are consistently lower than all of the following: the tax rates of its low-tax jurisdictions; the rates of a wide variety of comparable peers in comparable tax jurisdictions; its GAAP effective tax rate; and the level at which we’d expect it to pay taxes on its supposed pretax income.

- We tried to reconcile the differences we uncovered using explanations involving intercompany revenues, tax considerations, etc., but those explanations still defied economic logic. The numbers just don’t add up.

- It isn’t just profit margins. Amdocs’ revenue per employee is dramatically higher than a broad set of peers, including that of world-leading, high-margin IT services players…two standard deviations higher, in fact.

Auditors Resigning in Concerning Pattern:

- DOX has experienced a spate of recent and unusual auditor resignations at various subsidiaries. As multiple Big Four auditing firms have resigned, DOX has replaced them with scandal-plagued or tiny shops.

- One of these audit firms is notorious for helping none other than Donald Trump inflate his net worth to the public. Another, which took PWC’s place, appears to be a 9-person outfit based out of Switzerland.

- In the case of one DOX sub, an auditor resigned, and then its replacement resigned only a year later.

- We have investigated these auditor relationships and do not believe that normal auditor turnover or mere coincidence can explain these resignations. The “legit” auditors are quitting for a reason.

Undisclosed Debt a Growing Problem Alongside Trapped Cash:

- Approximately 1/3 of Amdocs’ stated cash (around $500m) is practically unavailable for use, but the company has hidden and misrepresented this problem in a variety of ways. Bondholders especially have been misled by the illusion of safety in this new-to-market, investment-grade issuer.

- Either cash is “trapped,” or it is not there at all. The latter scenario would be reminiscent of Wirecard.

- Unbeknownst to investors, Amdocs has been secretly borrowing a large amount of money for years but avoiding showing any debt as of each quarter-end. This is known as “window-dressing” the balance sheet.

- Such is why this company needed to begin selling receivables at a discount in FY18, as well as to utilize more value-destructive measures to raise cash since, despite claiming to have a huge excess cash pile. Of course, the company now shows $1bn in debt but claims not to need any of it – this is utterly false.

- Do the math yourself: If DOX’s EBITDA is overstated by $200m, and its available cash is overstated by $500m, what is the true EV/EBITDA multiple of this business? 15x, using consensus 2021 EBITDA1.

Former Employee Interviews Confirm Our Findings of Decline and Misrepresentation:

- Our key findings were consistent with what former employees and direct competitors told us.

- These disparate individuals tell the same story: DOX has been losing business for years but has made up for these losses by inflating financials, sometimes to a point beyond recognition by the country managers.

- One former American DOX executive told us that he and his colleagues had no idea how DOX managed to report stability in the US in the quarterly earnings results shown to Wall Street: “The US business was declining at a rate of [around] 7% annually…but then we would see the company [publish results that] say North America is stable…We would send [our quarterly numbers] to Israel…and somehow everything all comes out as favorable…every quarter [from 2016-on], that came as a big surprise.”

- Other formers/peers describe a business that is losing customers, most notably AT&T, piece by piece.

Amdocs is, ironically, perceived as a defensive name. It is also bizarrely expensive on an FCF basis compared to far-superior IT services companies such as Accenture or Genpact.2

Amdocs’ Profitability Inflated By ~40-50%: Subsidiary Filings Reflect The Reality

Amdocs has been vastly overstating the profitability of its business in its SEC filings and presentations to investors, and it has been doing so for years.

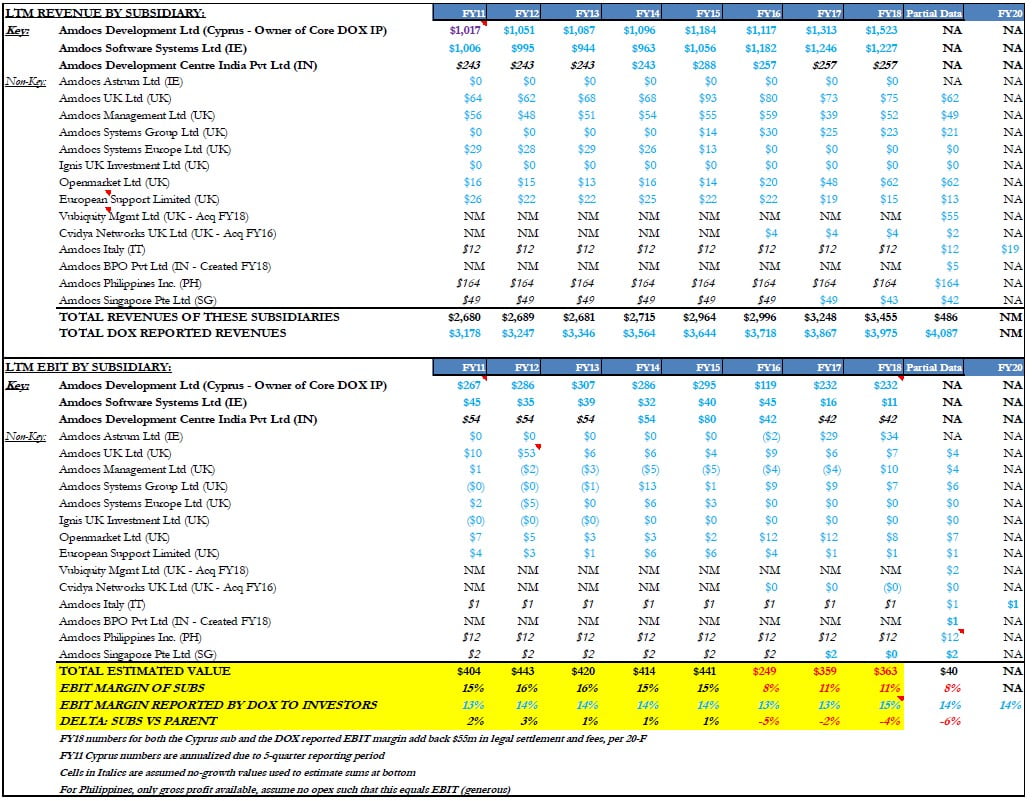

Over a period of months, we’ve dug up dozens of Amdocs’ subsidiaries from countries around the globe and counted up their revenues, profits, cash balances, etc. We found that while there was once a relationship between these subsidiaries’ operating profit margins and the profit margins the parent company reports in its SEC filings, this relationship no longer holds. The parent margins have held steady, but the subs’ margins have been deteriorating for a decade. We believe this difference is irreconcilable and is due to accounting aggression.

The underlying reality of Amdocs’ profits is a far-lower-profit business than what’s represented to investors. This reality happens to coexist neatly alongside the truth of Amdocs’ business: It is an India-based, BPO/offshoring business that competes with other single-digit-operating-margin, BPO businesses. What we have found about Amdocs’ true profitability shouldn’t be shocking to anybody who understands what this company actually does. Of course Amdocs is not a mid-teens operating margin business and hasn’t been for a very long time; what separates Amdocs from the pack isn’t a better business model, but creative accounting to manufacture the appearance of much more profitability than its true peers. We estimate this “magically created profit” totals as much as $200m annually for DOX.

The relationship between the profits of these subs and the profits of the parent has broken down completely through the latest available subsidiary filings:

The red line in the chart above shows the truth about the business’ profitability – the “Desert of the Real” for Matrix fans. The blue line is the result of Amdocs keeping investors in Wonderland with accounting magic tricks.

The source for this chart above is as follows:

If we gross up the missing profit margin from the subs above, it implies ~$200m of EBIT overstatement by the parent company, or ~50%:

- Reported annual DOX EBIT: ~$600m

- Reported annual DOX EBIT margin over past 2 years: ~14%

- Actual EBIT margin of subs over two most recent available years3: 9.4%

- “Deflated” DOX EBIT (9.4%/14% * $600m) = ~$400m

Let’s now walk through the appearance of Amdocs’ profitability, followed by the reality of its (far lower) profitability, and then look at some of the ways Amdocs has been able to create this mirage.

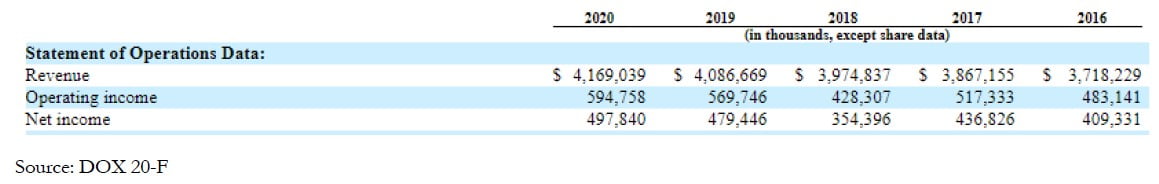

A. What we’re told: Amdocs has a “mid-teens operating margin,” magically outperforming its competitors

The “official story” is simply that which we see in the SEC filings: Amdocs is a stable, sleepy company with consistent, unremarkable margins for an “IT services” company:

Aside from FY18, when the company was hit with a one-time legal settlement charge and lost a couple points of margin, DOX has had remarkably consistent EBIT margins in the 13-14% range. In fact, holding aside the modest anomaly in FY18, DOX’s GAAP EBIT margin has been in this same 13-14% range in every year since 2006. Obviously, investors value this apparent consistency and predictability in DOX’s profit margins. And of course, we think that’s why DOX management has manipulated the numbers so aggressively to keep them looking nice and stable.

Read the full report here.