April

30, 2021

5 min read

This story originally appeared on MarketBeat

Crypto mania is bringing attention not only to the ever-burgeoning universe of currencies, but also to stocks like Coinbase Global (NASDAQ: COIN) and Marathon Digital Holdings (NASDAQ: MARA), as well as companies with high crypto exposure, like MicroStrategy (NASDAQ: MSTR).

Sure, the underlying industry or business case for a company makes a huge difference when selecting investments or trades. If there’s an industry-wide downturn or some kind of economic development affecting a company’s broader environment, the stock itself has a good chance of languishing.

It’s also not necessarily the case that every stock from a “hot” industry will be a winner.

There’s no shortage of new fintech companies. Of course, companies focused on blockchain and cryptocurrency are among those.

Bitcoin and other cryptocurrencies are off their recent highs, but that’s not necessarily a ding on companies involved in various aspects of the crypto industry.

These days, companies not involved in crypto mining or trading are staking much of their value on crypto. There are several new twists on “crypto exposure,” and investors can probably expect to see more.

Are these stocks shrewd buys, or should you avoid them?

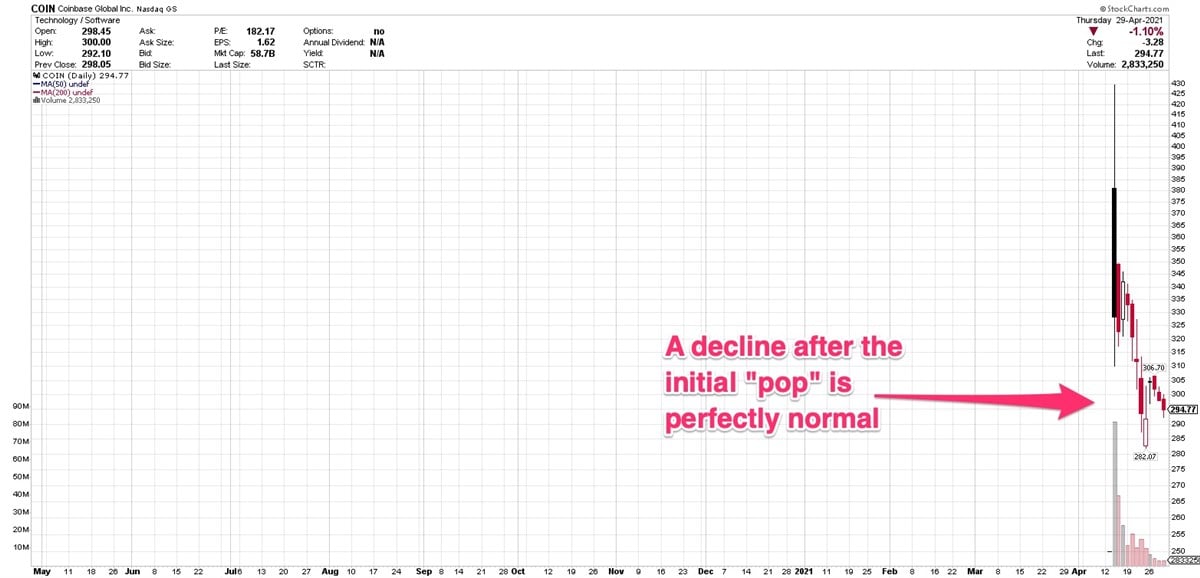

Coinbase went public on April 14, using a direct listing, rather than a traditional IPO. Ultimately, for retail investors, the means of bringing a company public doesn’t matter, if you are thinking of buying shares. Yes, the lack of IPO can affect the company’s financial structure and ability to raise capital, but that may or may not affect investors and traders down the road.

The crypto-buying app popped the day of its listing, then immediately pulled back. That’s not at all unusual for a new stock, and doesn’t mean the listing was a failure.

It shouldn’t come as a shock that the company was profitable in 2020, when people were home with extra cash from stimulus checks, and wanted a piece of the crypto trade.

If there’s a knock on the company, it may be that prices will tank or investors will sour on ethereum and bitcoin, two popular cryptocurrencies that generate revenue for Coinbase. There’s precedent for that: Revenue was erratic in 2019, as crypto prices were volatile.

It’s far too early in the company’s life as a public company to purchase shares. Let it develop a trading history, and watch how the company is able to maintain sales and earnings growth.

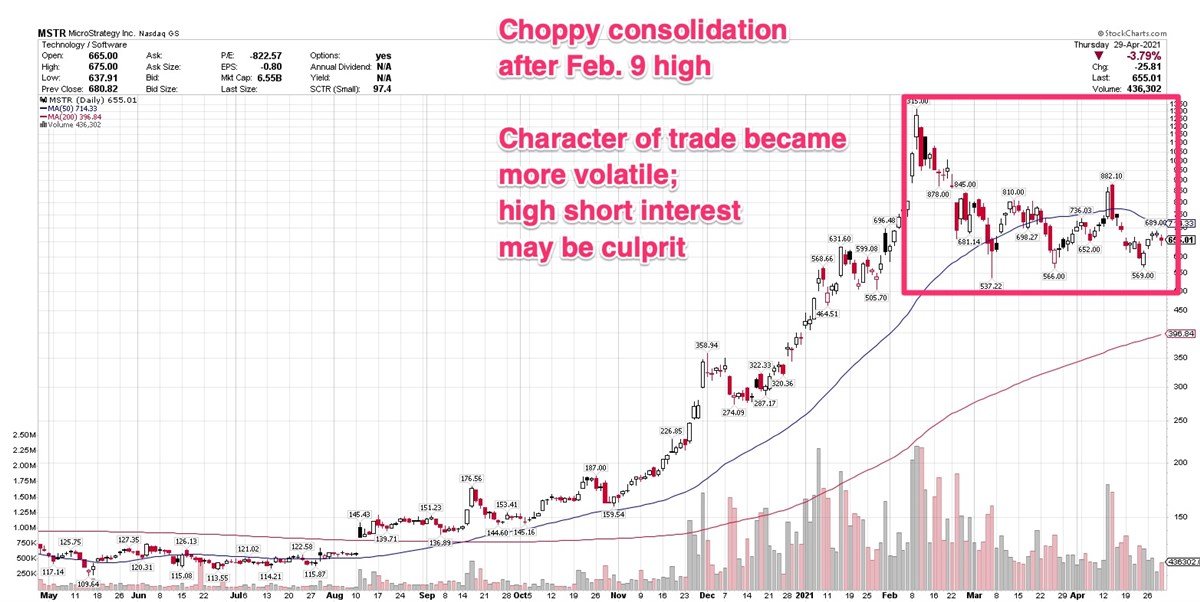

MicroStrategy, which is not a crypto company per se, has heavy balance-sheet exposure to bitcoin. The company was on the receiving end of a major investment bank ban on buying its shares – something you don’t see every day with stocks listed on a major exchange.

Last month, British bank HSBC said it would ban customers on its InvestDirect platform from buying shares of MicroStrategy.

Why would it take such a seemingly drastic move? Because it was concerned about CEO Michael Saylor’s moves to invest the company’s cash holdings into bitcoin. Not only did the company park cash in bitcoin, but in February, it issued debt to purchase more.

MicroStrategy provides enterprise business intelligence and analytics for use in various industries.

Unfortunately for investors, revenue at the enterprise software business – the part of the company that’s not a bitcoin bet – has been on the decline.

So what is the long-term plan here? Other companies, such as Tesla and Square have also invested heavily in bitcoin. It remains to be seen how much companies from other industries will pivot to being “crypto” companies, or if they settle down and refocus their attention on their stated business models.

The company reported a first-quarter loss of $11.40 per share after the close Thursday. Adjusted for costs and a one-time gain, the company earned $1.54 per share. Revenue was $122.9 million.

MicroStrategy is expected to see an earnings decline to the tune of 32% this year. That combined with the risky and uncertain nature of its bitcoin adventures, makes it something to avoid, for now, anyway.

Cryptocurrency miner Marathon Digital Holdings is currently forming a correction after pulling back from its April 6 high of $57.75.

The company has been busy. Last month, it announced a North American mining pool. A crypto mining pool is composed of miners who share the computing power in the process of mining. Rewards are also shared among the miners in the pool.

Earlier this month, Marathon said its bitcoin mining capacity grew more than 100% in the first quarter of the year.

Marathon has had an erratic history of moving in and out of profitability, not ideal when you’re considering an investment.

The company’s fate, at least for the moment, seems to rest largely on bitcoin prices.

Wall Street is optimistic about the Marathon’s fortunes, expecting earnings of $2.10 per share this year, a change of direction after four years of losses.

Featured Article: Why do companies issue stock splits?