May

10, 2021

6 min read

This story originally appeared on StockMarket

Are These Retail Stocks Worth Investing In Now?

While tech stocks may be off to a rough start in the stock market this week, investors may want to consider turning their attention to retail stocks. Why? Well, for starters, we will be getting a closer look at retail sales figures for April this week. Some would argue that solid results on this end could further support the current movement into reopening stocks. For one thing, investors appear to believe so. Namely, CNBC’s Jim Cramer had this to say, “I’d argue retail’s the real comeback story right now.” Seeing as this part of the stock market is made up of a wide variety of companies, investors would have plenty of options to choose from now.

On one hand, you have conventional retail players who remain on the uptrend as pandemic restrictions lessen. Take Funko (NASDAQ: FNKO) and L Brands (NYSE: LB) for example. Both companies would stand to benefit from more consumers visiting their brick-and-mortar stores now. As it stands both FNKO stock and LB stock are currently looking at gains of over 400% in the past year. On the other hand, there are e-commerce giants such as Etsy (NASDAQ: ETSY) and Pinduoduo (NASDAQ: PDD) as well. Sure, both companies’ shares have taken a breather from their pandemic highs. But, e-commerce will remain the more convenient method for consumers to shop, nonetheless. This would be the case seeing as countless consumers have and continue to rely on e-commerce services throughout the pandemic.

Overall, you could say that retail remains a viable industry across the board right now. As a result, I could see investors looking for the best retail stocks to buy this week. On that note, here are four top retail stocks worth taking note of in the stock market today.

Best Retail Stocks To Buy [Or Sell] Right Now

Nike Inc.

Nike is a retail giant that develops and sells athletic apparel and equipment. In essence, it is the world’s largest supplier of athletic shoes and apparel. It is a major manufacturer of sports equipment and is considered one of the most valuable brands among sports businesses. Nike markets its products under its own brand, as well as Nike Golf, Air Jordan, Air Force 1, Air Max, and Nike CR7 among others. NKE stock currently trades at $136.81 as of 3:49 p.m. ET.

In March, the company reported its third-quarter financials for fiscal 2021. Firstly, Nike reported a revenue of $10.4 billion for the quarter, a 3% increase compared to the prior year. Its Nike Direct sales were $4 billion, up by 20% on a reported basis. Its digital sales increased by 59% given the circumstances of the coronavirus pandemic. Secondly, net income for the quarter was $1.4 billion, a 71% increase or a diluted earnings per share of $0.90. This could imply that Nike’s brand momentum is as strong as ever and it continues to drive focused growth in its largest opportunities. With that being said, will you consider adding NKE stock to your portfolio?

[Read More] Best Stocks To Invest In Right Now? 4 Cybersecurity Stocks To Consider

JD is a leading technology-driven e-commerce company that is transforming to become a leading supply chain-based technology and service provider. To start things off, the company’s cutting-edge retail infrastructure seeks to enable consumers to buy whatever they want, whenever they want it. Part of its Retail-as-a-Service offering includes opening its technology and infrastructure to partners and brands. It is also one of the largest retailers in China. JD stock currently trades at $71.48 as of 3:50 p.m. ET.

The company reported its fourth-quarter and full-year 2020 financial results in March. Impressively, it reported a net revenue of $34.4 billion for the quarter, a 31.4% increase from a year ago. Net income attributable to ordinary shareholders for the quarter was $3.7 billion. Its annual active customer accounts increased by 30.3% to 471.9 million year-over-year. With a strong momentum going into 2021, the company says it will continue to invest in innovative, high potential businesses to drive long-term sustainable growth. Given this piece of news, is JD stock a top retail stock to consider buying?

Read More

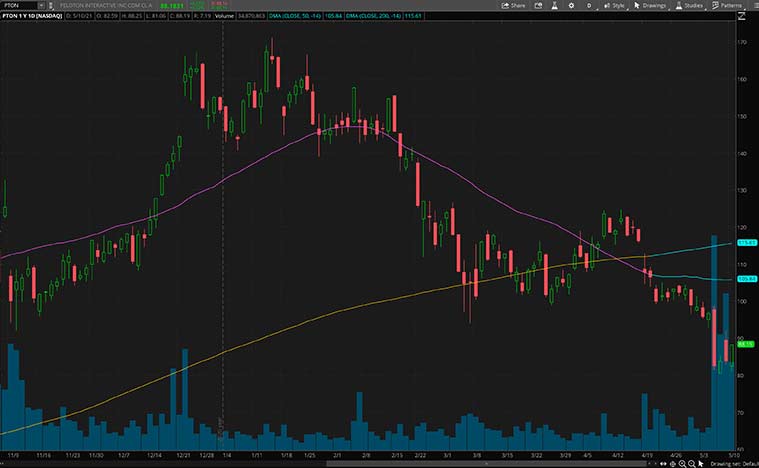

Peloton Interactive Inc.

Peloton is an exercise equipment and media company that is based in New York City. The company has a leading interactive fitness platform that boasts over 5.4 million members. It has essentially reinvented the fitness industry. Peloton does this by developing a first-of-its-kind subscription platform that seamlessly combines its exercising equipment, proprietary networked software, and world-class streaming digital fitness content. PTON currently trades at $87.78 as of 3:49 p.m. ET.

Last week, the company reported its third-quarter financials, much to investors’ delight. Total revenue for the quarter was $1.26 billion, an increase of 141% year-over-year. This was driven by strong demand for its Connected Fitness Products and an acceleration of deliveries as a result of expedited shipping investments. Its Connected Fitness Subscription grew by 135% to over 2.08 million and paid Digital Subscriptions grew by a whopping 404%. With such impressive financials, will you consider buying PTON stock?

[Read More] Hot Stocks To Buy? 4 Growth Stocks To Watch

Alibaba Group Holding Ltd

Among the e-commerce players in China, few can compare to the likes of Alibaba Group. If anything, most would consider Alibaba the Chinese counterpart to Amazon (NASDAQ: AMZN). Understandably, both are multinational tech companies that have expanded beyond their core e-commerce divisions.

In terms of scale, Alibaba reported a whopping total revenue of $34.45 billion in its recent quarter fiscal. On top of that, the company also saw its earnings per share surge by over 47% year-over-year as well. With Alibaba set to report its full fiscal year 2021 figures on Wednesday, investors could be watching BABA stock right now.

On the operational front, the company continues to make impressive strides forward. Late last month, Alibaba’s Taobao platform announced plans to “supercharge” its e-commerce ecosystem. In short, Taobao is planning to support 2,000 live stream channels and help 200 platform partners boost their annual sales significantly. By and large, this would serve to improve Alibaba’s relations with existing merchants. The company seems confident about its current strategy and appears to be doubling down on it. Time will tell if this will pay off for Alibaba in the long run. In the meantime, would you consider BABA stock a buy?