June

3, 2021

6 min read

This story originally appeared on StockMarket

4 Top Meme Stocks To Consider Watching Right Now

With all the buzz around meme stocks this week, more investors may be asking the question, “what are meme stocks”? For starters, this section of the stock market today is a blazing hot one at the moment, safe to say. Meme stocks initially came on to the scene in late January 2021. Namely, this was and is still thanks to retail investors on the social media platform, Reddit. Particularly, these investors banded together by pooling resources and pumping them into the most shorted stocks at the time. As a result, said stocks saw their values skyrocket overnight.

Now, some four months after the initial phase of this trading frenzy, meme stocks appear to be making a comeback. Along with several of the classic names, retail investors appear to have a growing meme stocks list to choose from. For instance, Beyond Meat (NASDAQ: BYND) and Koss Corporation (NASDAQ: KOSS) are joining the madness. BYND stock is up by over 40% in the past two weeks. More impressively, KOSS stock is looking at year-to-date gains of over 1,100%. While the current meme stock saga unfolds, more adventurous investors could be keen to jump on the meme train. In an age where meme stocks and meme cryptocurrencies dominate stock market news, I wouldn’t blame them for doing so. With all that said, here are four of the best meme stocks in the stock market now.

Meme Stocks To Buy [Or Sell] In June 2021

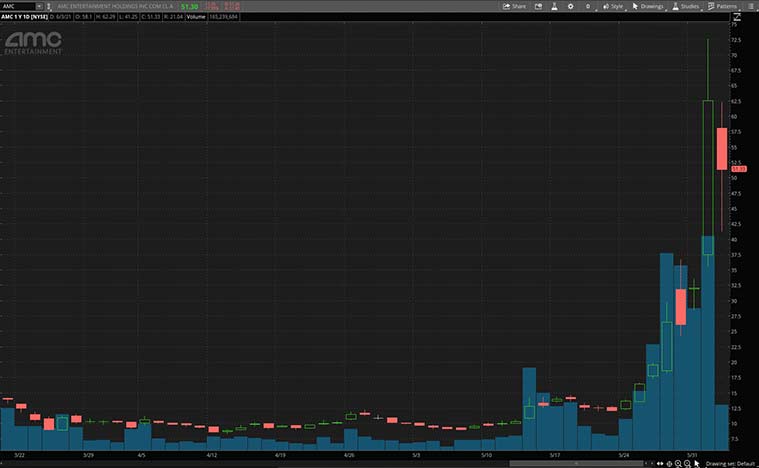

AMC Entertainment Holdings Inc.

AMC is a theater chain meme stock that has rocked the investment space in 2021. In fact, it is one of the largest movie exhibition companies in the U.S, and Europe. The company boasts over 900 theatres and 10,000 screens across the globe. AMC also innovates against its competitors by offering its Signature power-recliner seats and generates greater guest engagement through its loyalty and subscription programs. AMC stock has pulled back over 19% this morning. It currently trades at $50.80 as of 10:34 a.m. ET and has been up by over 80% just this week alone. Investors and retail traders seem to be responding to a press release by the company yesterday.

In it, the company launched AMC Investor Connect, an innovative, communication initiative that will put AMC in direct communication with its extraordinary base of enthusiastic and passionate shareholders. Individual investors who own AMC stock will receive special offers and other shareholder-exclusive promotions, including free or discounted items and invitations to special screenings.

They will also receive communications directly from the CEO of AMC, Adam Aron, and other interesting information about the company. Also, the company has been receiving heavy support from retail traders that have bought AMC shares and are holding onto them in a bid to further push its share price up. For these reasons, will you consider buying AMC stock?

[Read More] Best Growth Stocks To Buy Now? 5 Electric Vehicle Stocks To Watch

BlackBerry Ltd

BlackBerry is a multinational company that specializes in enterprise software and Internet of Things. The company, like AMC, seems to have gained meme sentiment on Reddit as retail investors rally behind the stock. BlackBerry is also well-positioned to secure all IoT endpoints and is leading the way with a single platform for securing and optimizing how intelligent endpoints are deployed. BB stock has been up by over 50% this week and currently trades at $17.90 as of 10:35 a.m. ET. Last month, the company announced BlackBerry Optics 3.0, its next-generation cloud-based endpoint detection and response (EDR) solution, and BlackBerry Gateway, the company’s first AI-empowered Zero Trust Network Access (ZTNA) product.

Using a prevention-first and AI-driven approach, the company’s new endpoint and security capabilities will help differentiate its extended detection and response (XDR) strategy.

Billy Ho, Executive Vice President of Product Engineering at BlackBerry said, “Traditional endpoint security alone is not enough to tackle the sophisticated threat landscape. Our end-to-end approach to cybersecurity is deeply rooted in Cylance AI and ML to provide enhanced visibility and protection against current and future cyber threats. As part of our XDR roadmap, we will continue to add new products and additional sources of security telemetry, such as user behavior, identity, network, data, application, and cloud to the Optics 3.0 cloud data lake.” In essence, this solution will enable more efficient and effective detection and response. Given the excitement surrounding BlackBerry, is BB stock a meme stock worth buying?

Read More

GameStop Corp.

GameStop is a video game and consumer electronics, retailer. In fact, it is one of the largest video game retailers in the world and has also been rapidly expanding its e-commerce capabilities. IT has over 4,000 stores and comprehensive e-commerce properties across 10 countries. GME stock currently trades at $256.28 as of 10:38 a.m. ET and has been up by over 55% in the last month. The company will report its first-quarter fiscal 2021 earnings after the market closes on June 9, 2021.

Given the excitement ahead of the company’s first-quarter financials, the stock has also received unprecedented support from individual and retail investors. If you told me GameStop was worth less than $5 per share a year ago, it would be hard to believe you today. As retail traders banded together against short sellers at the start of the year, it made GME stock one of the greatest comebacks in retail. All things considered, will you buy GME stock?

[Read More] Best Stocks To Invest In Right Now? 4 Cybersecurity Stocks To Consider

Bed Bath & Beyond Inc.

Bed Bath & Beyond (BBBY) and its subsidiaries is an omnichannel retailer that sells a wide assortment of merchandise. Specifically, its products are for the Home, Baby, Beauty, and Wellness markets. BBBY stock currently trades at $34.07 as of 10:35 a.m. ET. Yesterday, the company announced that it will launch three new Owned Brands this quarter, continuing the execution of its biggest product assortment change in a generation to rebuild its authority in the $180 billion home market.

Late last month, the company also announced that it has strengthened its same-day delivery services in the U.S. through a partnership with DoorDash (NYSE: DASH), making it easier and more convenient than ever to shop for its products. Through this partnership, it will expand BBBY’s same-day delivery to over 3,000 additional ZIP codes across the country. Seeing the scale of this partnership, will you consider buying BBBY stock for these reasons?