June

19, 2021

15+ min read

This story originally appeared on Due

Annuity rates are the percentage your annuity grows each and every year. Whether you’re still in the planning stages or have just recently retired, you’re probably concerned about being able to cover your living, healthcare, and medical expenses. You’ve also probably had many sleepless nights worrying whether you’re going to outlive your savings or not. While all retirement concerns are valid, there might be a rare one-fix solution to put your mind at ease. And, it’s through an annuity. The key is finding the right annuity for you. Here are the best annuity rates on the market.

Annuities are insurance contracts. They provide a guaranteed lifetime income and protection against losing your initial investment. You may be able to use an annuity to assist you with your long-term costs too. And, you can leave the balance to heirs.

Unfortunately, many people aren’t taking advantage of annuities. Maybe it’s because they’re overwhelmed by them — or overwhelmed by all things about retirement. And, that’s a fair point. After all, annuities come in a variety of flavors — just like ice cream.

For starters, an annuity rates can be either immediate (begin paying out now) or deferred (being paying out at a later date). Additionally, they might fall into the following annuity types;

- Fixed annuities promise to pay you a guaranteed interest on your contributions. Rates are often based on the current interest environment. Overall, a fixed annuity is the most straightforward and predictable.

- Fixed indexed income annuities also offer principal protection like a traditional fixed annuity. However, there is upside potential through index participation (such as S&P 500). Principal protection and growth.

- Multi-year guaranteed annuities (MYGA) offer a fixed rate of return, but for a specified period of time.

- Variable annuities are tied to an investment portfolio. So, payments can increase when the market is performing well and decrease when it’s not. You can expect higher returns, but there’s more risk involved.

- Registered index-linked annuities are relatively new and are tied to the stock market index. Gains are capped and losses are limited.

What to look for when buying an annuity?

Are you feeling comfortable enough with annuities now that you want to buy one? If so, you’ll want to keep the following in mind so that you’ll get the most out of the annuity.

Pick the right type of annuity for you.

If you’re allergic to peanuts, then you should stay far away from peanut butter ice cream. It’s kind of the same thing with annuities. If you’re already in retirement, then a deferred variable annuity probably doesn’t make much sense. Select the annuity that best aligns with your retirement plan and doesn’t exceed your risk threshold.

Check the annuity rates and terms.

Before committing to a contract, carefully review the rates and terms. It should be clearly stated when you can access your money, how much you’ll be receiving, and the fees associated with the annuity. For example, if you withdraw any money before you’re permitted, you’ll be subject to surrender charges.

Choose your salesperson wisely.

Since your broker has to put food on the table, they’ll earn a commission from annuity sales. Often, these costs aren’t disclosed. Find out how much they’re making off the sale. And, more importantly, that they’re not selling the wrong annuity just to cash in on a commission.

Select a financially strong insurance company.

Annuities aren’t backed by institutions like the FDIC. They’re also supposed to last you a lifetime. As such, you need to make sure that you’re working with an insurance company that’s in it for the long haul. You can make sure that they’ve received a high rating from third parties like A.M. Best, Moody’s, Standard & Poor’s (S&P), and/or Fitch, etc.

Some other considerations? How easy it is to sign up and fund the annuity, as well as access your money. Customer service and what you expect your payments to be should also be factored in. Also, look at the interest rates for payout.

But, since your time is valuable, we’ve gone ahead and listed the 25 best annuities that you should purchase. Each has met the criteria above. And, we’ve even broken the list down into the best fixed, fixed indexed growth, MYGA, variable, and registered index-linked annuities so that you can quickly find the right type of annuity for you.

Top Annuity Rates

1. Due Fixed Annuity

When it comes to fixed annuities, Due has quickly established itself as a market leader. Founded by entrepreneur serial and annuity expert John Rampton, the company has already secured over 12,000 registered users. Those who sign up for a Due account can anticipate a guaranteed annuity rate of 3% return. And, on average, users are receiving $2,100 in retirement income per month.

But what makes Due the nation’s top retirement app? Easy. It’s incredibly accessible and easy to understand.

Due was designed for the average person to finally grab a piece of that guaranteed income ice cream cake. As such, it’s one of the most straightforward and transparent annuities on the market. And, here’s how it works.

Just apply for a Due account. Don’t worry. It’s free and will take you under 10-minutes. Once you’re set-up, you’ll get 3% on every dollar deposited.

That’s it. No frills. No BS.

And, if you’re uncertain on how much you’ll need to save each month, there’s also a handy annuity calculator to determine this amount. And, all of your hard money is deposited into a Charles Schwab account. It’s then managed by Blackstone (NYSE: BX), and ATHOS Private Wealth. If you’re unaware, both have impeccable reputations as two of the best investment firms in the country.

2. American National Single Premium Immediate Annuity (SPIA)

Since 1905, American National has been providing insurance products and services, including annuities. The company has three annuity options; a fixed deferred annuity, index deferred annuity and an SPIA.

Because American National has an A rating from A.M. Best you can be certain that the company is financially strong and will be sticking around. That makes all of their offerings appealing. But, their SPIA is the superstar of the bunch.

With this annuity, you can convert a lump sum of money into a predictable income stream. In fact, a “joint life” option has an average annual income of $10,609 and an annual payout rate of 5.30% — but it changes with what the current percentages are at the time of payout. You can spread this income out over a number of years, making your taxes more manageable, and there are several cash-out options. That makes it easier to withdraw your money in case there’s an emergency — but as with all annuities, there are fees with early withdrawal.

3. CUNA Mutual Group MaxProtect Fixed Annuity

Issued by the CMFG Life Insurance Company, the MaxProtect Fixed Annuity offers a guaranteed and competitive rate. That means you don’t have to sweat market volatility. But, at the same time, your annuity will grow faster than other taxable investments like CDs.

CUNA also gives you the option to lock in your interest rate for 3, 5 or 7 years. Afterward, you have several options to turn your savings into a series of income payments. And, there are no contract, administrative or upfront fees.

A.M. Best rated CUNA “A,” Standard & Poor’s (S&P) gave it an “A+” and Moody’s gave it an “A2.” That means you should have no concerns over CUNA’s financial future.

4. New York Life Secure Term Choice Fixed Annuity II

In general, you can’t go wrong with any New York Life annuity. After all, the company has a long and rich history dating back to 1845. It also has an A++ from A.M. Best, and has been the top provider of fixed deferred annuities since 2010. The company has also received the highest score among individual annuity providers in customer service by J.D. Power.

But, we’ve selected the New York Life Secure Term Choice Fixed Annuity II as our favorite annuity offering from the company. It requires a $5,000 premium amount to begin, but there aren’t any annual charges. Annuity rates are subject to and depend on the length of the contract, but the Guaranteed Minimum Interest Rate (GMIR) is 0.05% (except in New York where it is 1%). And, you also have the option to go with a 3, 4, 5, 6, or 7-year policy.

5. American Equity GuaranteeShield

Online reviews for American Equity have noted that American Equity delivers outstanding customer service. And, as far as financial strength goes, it’s earned an A- (Excellent) from A.M. Best. Furthermore, the company has several different annuity options.

For our money, though, we like the GuaranteeShield series. It checks all the boxes for a fixed annuity, including;

- Principal protection

- Guaranteed income

- Tax-deferred growth

- Liquidity

- May avoid probate

You can also access up to 10% of your contract’s value each year and add on a market value adjustment and death benefit rider. Interest rates may vary each contract year. But, the GMIR will never drop below 1%.

Top Fixed Indexed Growth Annuities

6. AIG – Assured Edge Income Builder

With the Assured Edge Income Builder from AIG, you can reap the benefits of a fixed annuity. Additionally, your guaranteed lifetime income amount (GLIA) will increase based on a 7% income growth rate each year until you begin receiving payments. And, according to the company, the annual income credit is a dollar amount calculated by multiplying the initial GLIA by the 7% income growth rate.

But, there are a couple of other features that make this a highly coveted annuity. There’s also a market value adjustment and a flexible guaranteed withdrawal benefit (GLWB). For example, being able to take multiple withdrawals of up to 10% of your contract value as of the previous anniversary, with no withdrawal charge or market value adjustment (MVA).

You’ll need a $25,000 minimum deposit. And, you should also know that AIG has received an A from A.M. Best, A2 from Moody’s, A+ from S&P, and A+ from Fitch.

7. Nationwide – New Heights 9

Going back to 1926, Nationwide offers insurance, retirement, and annuity products. What makes Nationwide a top annuity company is that its products are flexible. For example, you can purchase a premium through a series of payments or just one lump sum.

In particular, the company’s New Heights 9 Fixed Indexed Annuity deserves a shoutout. As stated on the company’s site, “New Heights 9 tracks your potential strategy earnings also known as earnings, daily, and does not limit the amount of index performance used to calculate your earnings.” You also might be able to snag higher long-term accumulation depending on the performance of the underlying index and declared percentage or rate component.

Additionally, your money is protected from potential market risk. And, you can also tack on optional riders. One such rider worth considering is guaranteeing a lifetime income for you, your spouse, or heirs.

Additionally, Nationwide has landed high financial ratings. A.M. Best rated it an A+ (Superior), S&P gave it an A+ (Extremely Strong), and Moody’s rated it an A1 (Upper-Medium Grade).

8. Protective Indexed Annuity II

Protective has been in business since 1907. And, throughout the years they’ve garnered an A+ rating from A.M. Best, AA- from S&P, A1 from Moody’s, and A+ from Fitch. They also just so happen to be one of the top-selling registered-index-linked companies.

With that in mind, we would be remiss if we didn’t mention its Indexed Annuity II. The company promises protection on your principal, a lifetime stream of guaranteed income, and potential for higher growth based on the performance of the S&P 500 Index. One of the most appealing features, however, is that you’re able to access your money penalty-free if you become unemployed, terminally ill, or have to relocate to a nursing facility.

There’s a $10,000 minimum. But, you don’t have to be concerned with an annual contract fee.

9. Global Atlantic ForeIncome II

Global Atlantic offers several different annuity products including a fixed, variable, income, or fixed index annuity. And, it’s the latter that we want to focus on.

It turns out the Global Atlantic has five different fixed index annuities, FIAs for short. The purpose of these is that you’ll have greater growth potential than traditional deposit products, tax-deferred growth, and no market losses. Also, you can pass the balance on to your beneficiaries.

Specifically, the ForeIncome II stands out the most. It aims to provide you with a “retirement paycheck” for life. And, this is an extra income that you can’t outlive. What’s more, you have two withdrawal options;

- The Guaranteed Income Builder Benefit offers a steady, predictable income for your entire life.

- The Income Multiplier Benefit provides a steady income, but it grows by being tied to the S&P 500.

And, there’s no need to stress over Global Atlantic’s financial strength. The company has earned an A from A.M. Best, Fitch, and Moody’s, along with an A- from Standard & Poor’s.

10. Lincoln Financial OptiBlend

Lincoln Financial has been in existence since 1905. The company offers a wide range of products including annuities, life insurance, retirement plan services, and group protection. But, obviously, we want to highlight the company’s annuities — specifically the Lincoln OptiBlend.

This is a fixed indexed annuity. It has flexible premium annuities and offers a set interest rate for one year. Interest rates are declared annually. Another key feature includes a 5-year, 7-year or 10-year surrender charge schedule.

But, the standout is that your portfolio is tied to the performance of four different indexed accounts; the 1 Year Fidelity AIM Dividend Participation, 1 Year S&P 500 5% Daily Risk Control Spread, 1 Year S&P 500 Cap, and 1 Year S&P 500 Participation.

There’s a $10,000 minimum. But, no annual contract fees.

Top Multi-year Guaranteed Annuities

Before we can go any further, you must know that these rates change frequently. As such, the rates we’re including here are from June 2021. To check the most up-to-date rates, visit a source like Blueprint Income or the Annuity Guys.

11. Sentinel Security Life

This Utah-based business has been in operation since 1948. And, like insurers, they offer multiple annuity products including a fixed indexed and income annuity. However, the company offers some of the highest MYGAs annuity rates on the market.

Case in point, if you purchase a 10-year term, you’ll receive up to 3.20%. You’ll most likely need a $2,500 minimum initial premium — if you opt for Sentinel Security Life’s Personal Choice annuity. And, there aren’t any contract fees. We’re also like that if you become terminally ill or nursing home care withdrawal charges are waived.

What about Sentinel’s financial strength? A.M. Best ranked the firm at a B++ (Good). If you’re curious, this rating comes in eighth on A.M. Best’s scale of 21 possible grades.

12. Atlantic Coast Life Insurance

Founded in 1925, Atlantic Coast Life Insurance is based out of Charleston, SC. While the company may not be a household name, it also offers favorable MYGA rates. One of its best is its 20-year term annuity that will fetch up to 3.30%.

Just for comparison’s sake, CDs offered online are paying 3% or less on a five-year paper. And, CDs available at bank branches are substantially less than this. So, we’ll take that 3.30%.

If you’re wary about Atlantic Coast Life Insurance it was rated a healthy B++ by A.M. Best. And, you may even land a first-year bonus of an additional one percentage point.

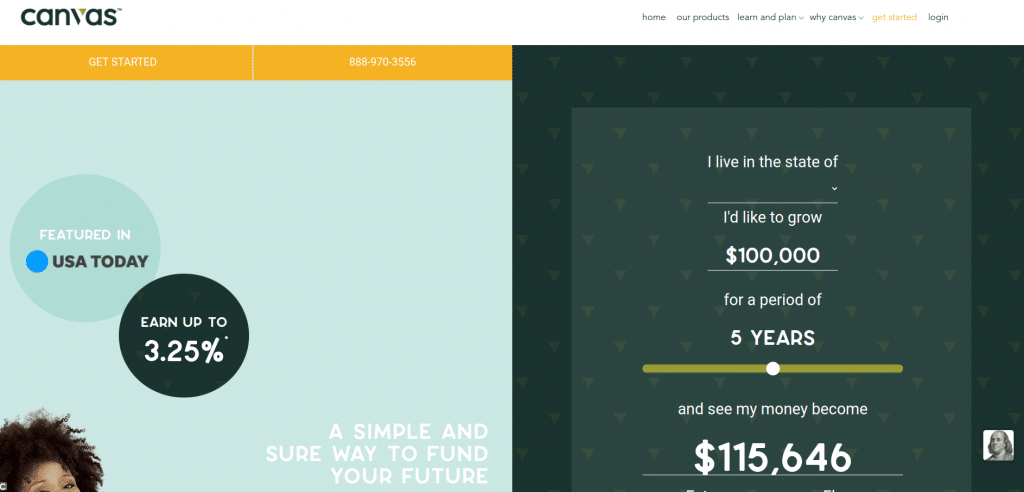

13. Canvas Annuity Future Fund

Canvas is built around being a people-first annuity company. It promises great rates, flexible access, and absolutely zero commissions. In short, the company states that its revolutionizing annuities.

Considering that Canvas has a guaranteed crediting rate for the following term, 7 years and it’s annuity rates are up to 3.25%, you can’t argue with that sentiment. Moreover, you have 24/7 access to your information online and it’s available for anyone aged 18-90 years old. You’ll just need a $2,500 minimum initial premium.

The Scottsdale, AZ company has a B++ rating from A.M. Best. And, its annuities are issued by Puritan Life Insurance Company of America.

14. Oceanview Life Harbourview MYGAs

A.M. Best has rated Oceanview an “A-”. Which means the company has a stable outlook. What’s more, the company had multiple interest guarantee periods — 3, 4, 5, 6, 7 & 10 Years. But, what’s interesting is that the issue age is 0 through 89.

But, the company also has competitive rates, such as its 10-year term and annuity rate up to 3.10%. You’ll need a $20,000 premium requirement and there is a market value adjustment. And, the company also offers 10% free withdrawals.

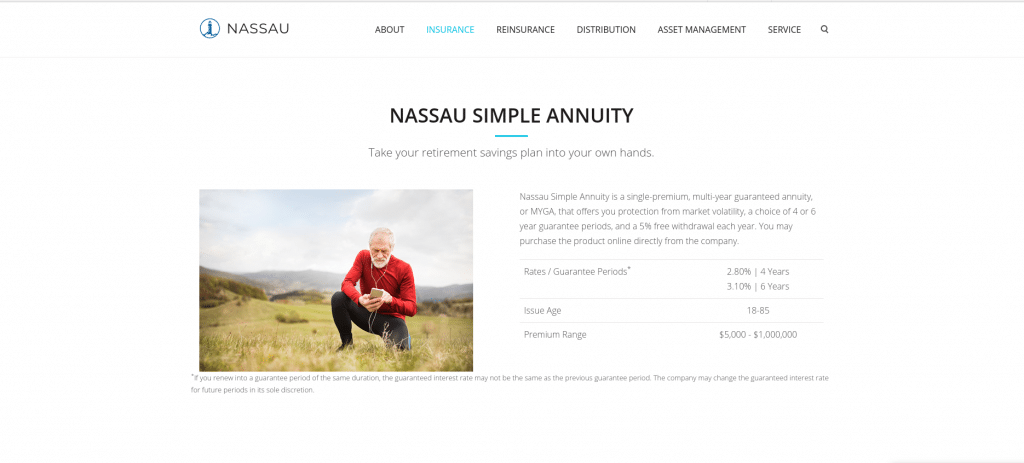

15. Nassau Simple Annuity

Based in Hartford, CT, Nassau Financial Group covers insurance, reinsurance, distribution and asset management. However, you probably can’t go wrong with its 6-year term where you’ll earn up to 3.10%.

Overall, this is a single-premium, multi-year guaranteed annuity that offers protection from market volatility. The premium range is between $5,000 – $1,00,000. Also, the issue age is 18-85.

The company’s financial strength is solid as it has received a B+ from A.M. Best.

Top Variable Annuities

16. Fidelity Personal Retirement Annuity

Fidelity offers six quality annuities. And, it’s this variety, along with the company’s reputation for delivering stellar customer service, that makes it stand out. But, we’re fans of the Fidelity Personal Retirement Annuity.

Considered a top variable annuity by Barron’s this is a low-cost, tax-deferred annuity that gives you three different investment approaches, as described by the company;

- A hands-off approach might be a fit if you don’t want to actively manage your portfolio and prefer to choose one single fund where Fidelity provides automatic diversification and professional money management.

- A hands-on approach might be a fit if you want to manage your own investments. You’ll be able to utilize our powerful research tools to choose from more than 55 Fidelity and non-Fidelity funds, many rated 4 or 5 stars by Morningstar.

- A sector investing approach might be a fit if you are interested in managing your own investments while focusing on 11 funds that each represent a specific segment of the economy.

A minimum investment of $10,000 is required. But, the annual annuity fees are some of the lowest in the industry — 0.25% for contracts purchased with an initial investment of less than $1 million.

17. Jackson National Life Perspective II

Even though Jackson National Life is a subsidiary of the British insurer, Prudential plc., its origins go back to 1961 in Jackson, Michigan. Over the years, the company has earned a solid reputation for its financial strength. In fact, Jackson National Life Insurance has received an A (Excellent) rating from AM Best.

The company offers fixed fixed index, and variable annuities. And, it’s its variable annuities that we want to shine a spotlight on. In particular, it’s the Perspective II contract.

It requires a minimum initial premium of $5,000 and has a $35 annual contract charge. You should also expect additional fees like a 1.30% core contract charge and 0.53% – 2.41% annual portfolio operating expenses.

Despite these fees, this annuity is designed for long-term investors with a timeframe of seven or more years. Most appealing is that you can attach the LifeGuard Freedom Flex. In a nutshell, this is Jackson’s version of the income rider benefit with an annual bonus guarantee of 7%. There’s also the opportunity to leave a legacy. And, you can view data for each of its variable annuity products through a partnership with Morningstar.

Finally, Jackson National Life is financially strong as it received an A (Excellent) rating from AM Best.

18. Transamerica Life Principium IV

Transamerica is one of the industry’s leading firms. The company has been around since 1928 and shows no signs of slowing down. After all, it’s securely landed within the top quarter of the A.M. Best, Moody’s, S&P Global, and Fitch scoring structures.

While the company does offer a variety of annuities, we’re partial to Principium IV. Fun fact. The word Principium comes from Latin to signify origin or root. The word itself, however, means principle — especially a basic one.

Overall, this is a lower-cost variable annuity containing a five-year surrender charge schedule. Other key features include automatic asset rebalancing, free transfers between subaccounts, and the ability for annuitization after the third policy anniversary. There’s also a dollar-cost averaging feature that will purchase more units when prices are low and fewer when prices are high.

A minimum initial premium of $1,000 is required if qualified and $5,000 for unqualified. There’s also a $35 annual service charge.

19. MassMutual Transitions Select II

MassMutual is known for providing a plethora of investment options for its variable annuity owners. And, each offering has varying philosophies and risk tolerance levels. As such, you might be able to find a product that fits you like a tailored suit.

If you want investment to be at the core of your variable annuity, then your best option is the Transitions Select II product. You can choose sub accounts that are managed by some of the industry’s heaviest hitters including Oppenheimer Funds, Fidelity, Black Rock, and Franklin Templeton Investments.

There are also flexible payment arrangements after five years and free withdrawals that are up to 10% of purchase payments. You can also sign-up for MassMutual’s free automatic investment plan (AIP) and automatic rebalancing program.

An initial investment of $3,000 (qualified), $5,000 (non-qualified), is required. There’s also a $40 annual contract maintenance fee. And, if you’re curious about its financial ratings, here’s what MassMutual has received:

- Fitch: AA+ (the second-highest of 21 grades)

- A.M. Best: A++ (the highest category of 15)

- Moody’s: Aa3 (fourth-highest of 21)

- Standard & Poor’s ranks it at an AA+ (second-highest of 21)

20. Brighthouse Financial Variable Annuities with FlexChoice Access

A variable annuity from Brighthouse, which has received an A rating from A.M. Best and Fitch, as well as an A+ from Standard & Poor’s, has the standard features you’d want. These include a guaranteed lifetime income and flexible investment options based on your personalized investment strategy. You can also set it up so that your spouse will continue to receive your payments.

But, it’s the FlexChoice option that makes this annuity worthy of inclusion. For starters, you’ll receive 5% annual compounding for the first 10 years of your contract. There’s also the ability to automatically lock in market gains and take either 6% or 4.75% withdrawals at age 65.

There’s a $10,000 minimum initial premium and a $30 annual contract fee. You should also expect additional fees, such as a 0.53% – 1.67% fund expense fee and 1.30% mortality/ expense/administration charge.

Top Registered Indexed Annuities

21. Athene Amplify

Like a Phoenix emerging from a financial crisis, since launching in 2009, Athene has quickly become an annuity market leader. In particular, its Amplify product is a shining star.

This is a 6-year registered index-linked annuity that allows you to pursue growth opportunities so that you’ll get the most out of your annuity without taking on too much risk. There’s also a lot of flexibility with this annuity. For starters, Amplify offers 1, 2 and 6-year term periods. There’s also 4 different index options. And, you can also leave a legacy.

In regards to its financial strength, Athene has scored an “A” from A.M. Best, Fitch, and S&P.

22. Equitable Structured Capital Strategies

Equitable Holdings Inc. was founded back in 1859. And, because of its financial strength, you can be confident that the company will be around for the foreseeable future. It has received an A from A.M. Best, A2 from Moody’s, and A+ from Standard & Poor’s.

As for annuities, we can get behind its Structured Capital Strategies variable annuity. Mainly because, as stated on its website, it “adapts to your unique investment styles so you can work toward your individual retirement goals on your terms.”

Specifically, this annuity provides the following;

- Levels of downside protection that are up to -30%

- Participation in indices, like the S&P 500 and Russell 2000, with the ability to up to a set performance cap rate, while also limiting your potential loss

- Customization, such as the maturity date (1, 3, or 5 years), how much you’re willing to risk, and the index you’d like to base the performance of your investment

You’ll need $25,000 to get started. And, there will be fees like a 1.65% variable investment option fee and 0.58% – 0.71% annual portfolio operating expenses.

23. Allianz Index Advantage

This is the company’s core index variable annuity. It’s “designed to help you accumulate money for retirement and provide income after you retire,” Allianz states on its website. “It can give you long-term growth potential through market participation – plus a level of protection – through a combination of traditional variable options and multiple index strategies.”

However, this annuity really shines because you can subscribe to a specific type of index strategy through the company. That’s a stark contrast to other annuities where the portfolio is constructed with securities, indexes, and investment strategies.

Note that there are two separate annual fees associated with the Allianz Index Advantage Variable Annuity. The first is a 1.25% product fee, as well as a 0.64% to 0.72% variable option fee. But, if you annex the optional death benefit plan for an additional 0.20% fee will join it.

Also, don’t forget about the $10,000 minimum initial premium. And, if you’re a curious cat, Allianz has a solid A+ AM Best Rating.

24. Nationwide Monument Advisor

Nationwide, and its superior A+ rating from A.M. Best, offers the industry’s first flat fee, Investment Only Variable Annuity (IOVA). As such, there’s a low-cost $20 per month flat fee. How far will that get you? Well, this annuity has over 350 investment options — which is the largest in the industry.

As such, this annuity is ideal if you’re looking for a low-cost option and/or investment diversification. In fact, it’s these two features that make the Nationwide Monument Advisor so engaging.

Just take note that you may have to pay other fees as well. For example, additional fund platform fees can range from 10% to 35%. So, if you’re not careful, this low-cost, tax-deferred annuity could become rather expensive. And, a $15,000 minimum deposit is also needed.

25. Prudential FlexGuard Indexed Variable Annuity

And, finally, we have the FlexGuard Indexed Variable Annuity from Prudential. This Fortune 500 company, which has an A+ from A.M. Best, states that this annuity can simplify your retirement planning while avoiding exposure to markets. It can also produce a reliable, “pension-like” guaranteed income stream.

FlexGuard also allows you to choose your buffer level as well as your term length and to allocate your money. This will be through well-known indices like S& P 500, iShares Russell 2000 ETF, Invesco QQQ ETF, and MSCI EAFE. And, perhaps most tempting, is that you can also select your own growth opportunity based on three different index returns; Point-to-Point with Cap Rate index, Tiered Participation Rate index strategy, or Step-Rate Plus.

You’re permitted to withdraw up to 10% of all purchase payments each year without incurring any surrender charges — just as long as the withdrawal is made within the surrender charge period. Other contract charges include Mortality, Expense, and Administration charges of 1.30% (M&E&A). These apply only when you allocate money to variable sub-accounts. And, a minimum purchase payment of $25,000 is required.

Here’s a summary of the best annuity rates of 2021

| Annuity Name | Type of Annuity | Deferred or Immediate? | Key Feature | Minimum Initial Premium | Guaranteed Rate of Return | Contract Term | Withdraw? | Annual Fees | A.M. Best Rating |

| Due Fixed Annuity | Fixed | Both | Accessibility. Anyone can apply in under 10 minutes. | $0.00 | 3.00% | – | Withdraw at anytime, Free – up to 10% of contract value | $10/month | – |

| American National Single Premium Immediate Annuity (SPIA) | Fixed | Immediate | Flexibility, like multiple income payment options. | $0.00 | 5.30% | – | Partial | None | A |

| CUNA Mutual Group MaxProtect Fixed Annuity | Fixed | Both | A market value adjustment and book value version | $10,000.00 | – | 3, 5, or 7 years | Free for health hardship | None | A |

| New York Life Secure Term Choice Fixed Annuity II | Fixed | Deferred | A market value adjustment that could boost your finances | $5,000.00 | 0.05% | 3, 4, 5, 6, or 7 years | Free – up to 10% of contract value | None | A++ |

| American Equity GuaranteeShield | Fixed | Deferred | Principal protection and guaranteed lifetime income | $10,000.00 | Never below 1% | 5, 6, or 7 years | Free – up to 10% of contract value | None | A- |

| AIG – Assured Edge Income Builder | Fixed Indexed Growth | Both | You can decide when payments will begin | $25,000.00 | 7.00% | 7 years | Multiple – up to 10% | None | A |

| Nationwide New Heights 9 | Fixed Indexed Growth | Deferred | Principal protection with higher long-term accumulation | $25,000.00 | 2%-5% | 9 years | Free – 7% of the contract’s value on the first day of the contract year | None | A+ |

| Protective Indexed Annuity II | Fixed Indexed Growth | Deferred | Can access money penalty-free if unemployed, terminally ill, or have to relocate to a nursing facility | $10,000.00 | 1.20% – 1.55% | 5 or 7 years | See “Key Feature? | None | A+ |

| Global Atlantic ForeIncome II | Fixed Indexed Growth | Deferred | Guaranteed Income Builder Benefit offers a steady, predictable income for your entire life. | $25,000.00 | Linked to S&P | 5, 7, or 10 years | Free – up to 10% of contract value after 6 years | None | A |

| Lincoln Financial OptiBlend | Fixed Indexed Growth | Deferred | Performance of portfolio is tied to the performance of four different indexed accounts | $10,000.00 | 1.90% on premium amounts of $100,000 – $2,000,000 | 5, 7, or 10 years | Free – up to 10% of contract value | None | A+ |

| Sentinel Security Life | Multi-year Guaranteed | Deferred | If you become terminally ill or nursing home care withdrawal charges are waived. | $2,500.00 | 3.20% | 10 years | None | B++ | |

| Atlantic Coast Life Insurance | Multi-year Guaranteed | Deferred | A favorable rate that’s higher then financial products like CDs. | $2,500.00 | 3.30% | 10 years | None | B++ | |

| Canvas Annuity Future Fund | Multi-year Guaranteed | Deferred | Accessibility. Anyone over age 18 can apply. And, you can access your account 24/7 | $2,500.00 | 3.30% | 20 years | None | B++ | |

| Oceanview Life Harbourview MYGAs | Multi-year Guaranteed | Deferred | Market value advisement, as well as expansive age range from 0 to 89 | $20,000.00 | 3.25% | 7 years | Free – up to 10% of contract value | None | A- |

| Nassau Simple Annuity | Multi-year Guaranteed | Deferred | Single-premium, multi-year guaranteed annuity that offers protection from market volatility | $5,000.00 | 3.10% | 3, 4, 5, 6, 7 & 10 years | Free – up to 10% of contract value | None | B+ |

| Fidelity Personal Retirement Annuity | Variable | Both | Offers three different investment styles; hands-on, hands-off, sector investing. | $10,000.00 | – | 6 years | Free – up to 5% of your contract value | None | A- |

| Jackson National Life Perspective II | Variable | Deferred | Highly customizable with a max annuization age of 95 | $5,000.00 | – | – | Free – up to 10% of contract value | 0.25% for contracts purchased with an initial investment of less than $1 million (or which have not yet accumulated $1 million) | A |

| Transamerica Life Principium IV | Variable | Deferred | Back to basics with an investment only strategy | $1,000.00 | – | 7 years | Free – up to 10% of contract value | $35 | A |

| MassMutual Transitions Select II | Variable | Deferred | Choose sub accounts that are managed by Oppenheimer Funds and Franklin Templeton Investments. | $10,000.00 | – | – | Free – up to 10% of contract value | $40 | A++ |

| Brighthouse Financial Variable Annuities with FlexChoice Access | Variable | Both | Receive 5% compounding and Automatic Step-Ups | $10,000.00 | – | – | Free – up to 10% of contract value | $30 | A |

| Athene Amplify | Registered Index | Both | Four different index options. | $10,000.00 | 1, 2, or 6 years | Free – up to 10% of contract value | $30 | A | |

| Equitable Structured Capital Strategies | Registered Index | Both | Customizable and levels of downside protection that are up to -30% | $25,000.00 | Free – up to 10% of contract value | 1.15% variable investment option fee | A | ||

| Allianz Index Advantage | Registered Index | Both | Ability to subscribe to a specific type of index strategy through the company. | $10,000.00 | Free – up to 10% of contract value | 1.25% annual product fee | A+ | ||

| Nationwide Monument Advisor | Registered Index | Both | The industry’s first flat fee, Investment Only Variable Annuity (IOV) | $15,000.00 | Free – up to 10% of contract value | $20 | A+ | ||

| Prudential FlexGuard Indexed Variable Annuity | Registered Index | Both | Provides a guaranteed income stream with ability to choose buffer level | $25,000.00 | 1, 3, or 6 years | Free – up to 10% of contract value | None | A+ |

Methodology

In order to determine the best annuity rates for each category, we considered the costs and benefits of each annuity on the market. Costs of each annuity include: the annual fee, withdraw transaction fee and the annuity rate offered by the annuity company. Benefits and perks are different for each person. Initial contribution minimums tends also be a large contributing factors in your purchasing or not purchasing.

In addition, each annuities category has its own criteria. For fixed annuity rates we also considered how much value you can expect to get guaranteed over the volatility in a variable or indexed annuity rate. We find fixed annuity rates range from 1% to 3%. Variable and Indexed tend to be from -2% to 6% interest on your money. This was a large factor in which annuity rate has the lowest net cost.

For annuities meant for those who are trying to build long term retirement or have 15+ years till retirement, we focused on annuity offers that offer the most opportunities to have a sustainable rate over the longest period of time with lowest net cost to the consumer.

For indexed annuities we looked at the length of variable rate, minimum initial premium and fees.

Every A.M. Best Rating was factored when comparing which annuity rate is the best.

Other Annuity Facts To Be Considered

The post Best Annuity Rates: Find the Right Annuity Provider for Your Retirement appeared first on Due.