April

30, 2021

7 min read

This story originally appeared on StockMarket

Should Investors Buy These Electric Vehicle Stocks Right Now?

Electric vehicles are racing to capitalize on the shift towards battery-powered cars, and EV stocks have been keeping pace. After such a monstrous run among top EV stocks in 2020, everyone has been looking for the next Tesla. In addition, there are also increasing interests in autonomous driving technology. But that doesn’t mean things will be smooth sailing for the carmakers. Unless you have been living under a rock, you would know that the global chip shortage is a pressing issue for the sector in the stock market today.

For instance, Ford Motor Company (NYSE: F) traded sharply lower on Thursday amid ongoing chip shortages. This could force the automaker to cut half of its planned second-quarter production. To be clear, it is not only Ford that is facing this issue. Rather, this is a systemic issue that affects all-electric vehicle companies. Having said that, once we get past this global chip shortage, top electric vehicle stocks will bounce back in no time. For investors willing to wade in with a longer-term mindset, there could be attractive entry points in the stock market right now.

According to Fortune Business Insights, the global electric vehicle market will be worth $985.72 billion by 2027. That represents a compound annual growth rate (CAGR) of 17.4% over the next six years. And there isn’t only one way to ride the EV boom. Beyond the electric vehicle makers, there are also pick-and-shovel plays that could do just as well in terms of returns. Now, with President Joe Biden making climate change a priority in his administration, top EV stocks could become even more attractive to investors. Things certainly look promising as the president calls for sweeping changes to bolster the EV industry. With that in mind, here is a list of the best EV stocks to watch in the stock market this year.

Best Electric Vehicle Stocks To Watch In 2021

Nio Inc.

Most auto investors would be familiar with China-based EV company, Nio. This is because it has been hailed as China’s equivalent of Tesla. The company reported its latest quarterly results and sales that topped Wall Street’s expectations on Thursday. But that barely moved the needle for NIO stock amid renewed concerns about its supply chain and the impact of semiconductor shortages plaguing the EV space. Apart from the chip shortages, the company’s fundamentals remain intact.

“The overall demand for our products continues to be quite strong, but the supply chain is still facing significant challenges due to the semiconductor shortages”– Chief Executive William Li. The company delivered 20,060 vehicles in its first quarter, an increase of 423% from the first quarter of 2020 and a rise of nearly 16% from the fourth quarter. Nio expects delivery of between 21,000 and 22,000 for the current quarter.

Despite having production hiccups, Nio can still topple favor to its side if it plays its cards right. After all, the Chinese government is going full swing in adapting its fleet vehicles into electric-powered alternatives. Expect sales to grow once the chip shortage is alleviated and delivery of its newest models is in full swing. The question is, will investors buy NIO stock amid the recent weakness?

[Read More] 4 Top Advertising Stocks To Watch Right Now

Tesla

Anyone who is bullish in the EV space knows what Tesla is truly capable of. While we all know TSLA stock has been hot over the past year, the stock price reaction this week may confuse some investors. In case you missed it, Tesla reported its first-quarter 2021 numbers earlier this week. Revenue came in 76% higher year-over-year. Deliveries are up 109% and its first-quarter orders were the strongest in the company’s history. Simply put, Tesla is firing on all cylinders. But why is its stock sliding this week?

Perhaps, it may be due to analysts having a mixed outlook towards the EV giant. In particular, Jefferies analyst Philippe Houchois called the quarter’s results “mixed”, and he reaffirmed a $700 12-month price target. Besides, Cathie Wood’s flagship Ark Innovation fund has allowed its stake in TSLA stock to slip below 10% this week for the first time in over a month.

Now, it seems like there’s a little “buy the rumor, sell the news” action here with TSLA stock. Investors have been bidding up TSLA stock up to its quarterly report this Monday. It’s safe to say that some investors are doing some profit-taking. I don’t know about you, but the numbers from Tesla’s earnings this week seem to suggest that the growth trajectory remains robust for the near term. Could the recent weakness be a buy-on-dip opportunity for investors? If you are one of its believers, would you jump on the TSLA stock bandwagon?

Read More

ChargePoint Holdings

Next up, we have EV charging stock, ChargePoint Holdings. It is an EV infrastructure company that operates one of the largest networks of EV charging stations in the U.S. The company is the first EV charging stock to have gone public via the SPAC route. This came after the completion of its merger with Switchback Energy Acquisition. Investors are bullish on CHPT stock with the backdrop of Biden’s ambitious $2.3 trillion infrastructure plan.

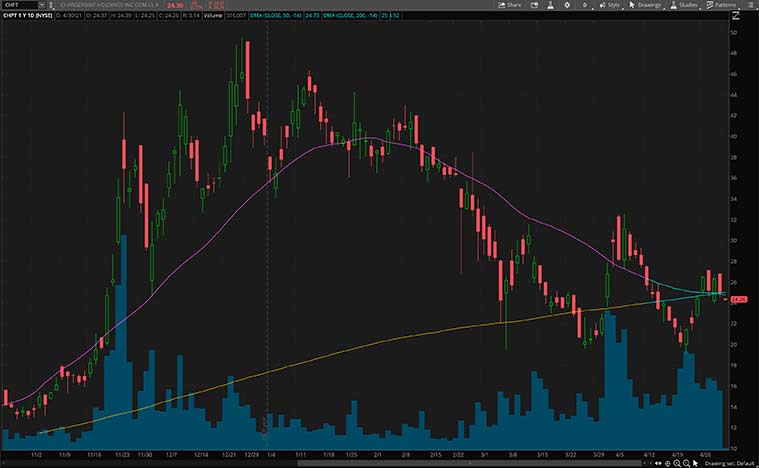

The company’s stock price hit an all-time high near $50 before correcting to its current level of around $25. Similar to other top EV charging stocks in the market, CHPT stock today trades at a more attractive valuation than where it was a few months back. Despite the correction in share price, nothing has really changed fundamentally for the company.

With over 90 million charges delivered, the company continues to expand its vertical by providing its solution to large fleets and businesses. Along with many electric vehicle stocks benefitting from Biden’s infrastructure plan, is it safe to say there’s more room to run for CHPT stock? With the White House reiterating its plan to build more than 500,000 EV chargers over the next decade, would buying CHPT stock now be a great idea considering it commands a huge market share in the country?

[Read More] Top Tech Stocks To Buy Now? 4 To Consider

Fisker Inc.

Over the past year, the competition for attention has intensified dramatically and has brought numerous EV start-ups onto investors’ radar. Thus, it is clear that this is not a winner-takes-all market. One brand that stood out is Fisker. And Fisker is one of the many EV makers that want to take a cut from the booming EV sector.

Founder Henrik Fisker is known for creating some of the most beautiful cars on earth. With that in mind, the company is leaving the manufacturing and maintenance work to its partners including Magna International (NYSE: MGA) and Apple’s (NASDAQ: AAPL) contractor Foxconn to build its vehicles.

Sure, it may take time for this electrification play to truly pay off. Should Fisker execute its asset-light model strategy well, it could bring in strong returns without substantial investment in plants and supply chains. Besides, Henrik Fisker announced on Twitter (NYSE: TWTR) earlier this month that reservations for the Fisker Ocean SUV have surpassed 15,000 units. With that in mind, would you consider buying FSR stock now?