June

21, 2021

7 min read

This story originally appeared on ValueWalk

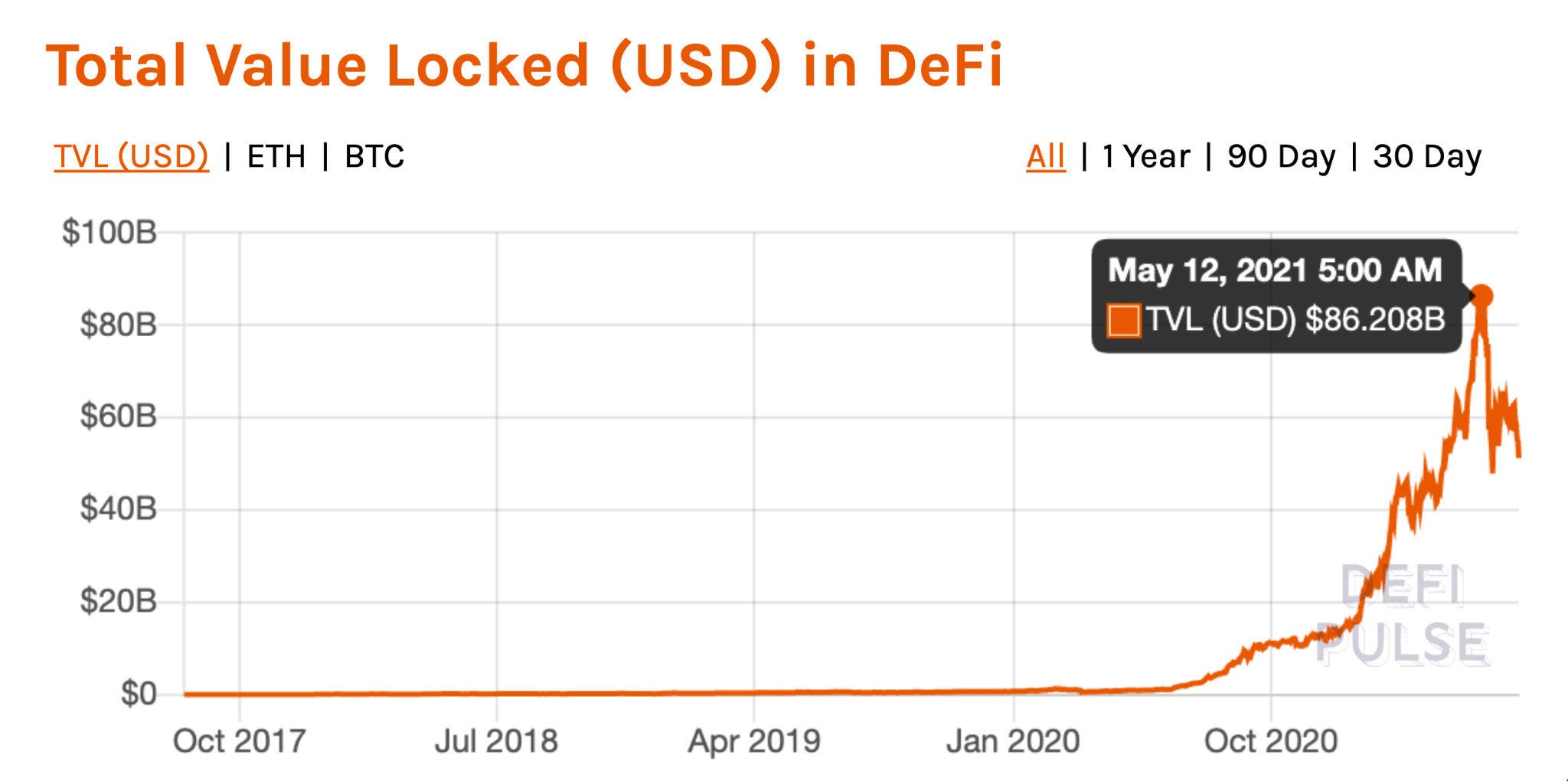

Defi is believed to overthrow traditional finance due to its accessibility, sphericity, efficiency, and ease of value transfer. During the recent bull run, the Defi market spiked over $149B, and the total value locked (TVL) in various DeFi protocols surpassed $86B.

[soros]Q1 2021 hedge fund letters, conferences and more

Defi banks on the inefficiencies of the traditional finance system where financial applications are expensive, difficult to access, and most importantly, hard to use. However, the maximalist slogan ‘Defi will eat Cefi’ seems far-fetched, as governments, banks, and infrastructure providers are jumping on the bandwagon as they experiment with decentralized protocols to cut costs, increase transparency, and speed up their processes.

The future lies in a hybrid model where traditional finance institutions work in tandem with Blockchain technology and Defi protocols to create new digital experiences for the masses. With Payment giants such as Mastercard, PayPal, and Visa embracing the technology, we could see this future sooner than ever.

Let’s explore how Defi is reshaping traditional finance where execution, post-trade processing, and settlement are near instantaneous.

Digital Banking Powered by DeFi Protocols

Netherlands-based ING Bank released a paper this year titled “Lessons Learned from Decentralised Finance”, and concluded that “the best of both worlds is achieved if centralized and decentralized financial services cooperate”.

They also mentioned that Defi protocols bring more accuracy, speed, and transparency; the kind of characteristics that we usually don’t see in traditional banking due to their legacy infrastructure. Historically, banks are a slow-moving industry, and with the inception of online digital services, banks have struggled to keep up with the technology.

Defi presents a tremendous opportunity to bridge the gap between legacy infrastructures of traditional finance and cutting-edge technology that is open, accessible, and borderless. Let’s see how Defi is disrupting the three most prominent sectors in traditional finance, i.e., cross-border payments, trade finance, and P2P lending, and enable banks to take advantage of this trust-less and decentralised technology.

Cross-border payments

The new generation of digital-savvy consumers uses services like PayPal, Venmo, and Revolut to transfer money in seconds. But when it comes to banks, they rely on legacy infrastructures for processing payments, such as SWIFT, IBFT, and ACH that not only cause delays in a local transfer but might take hours or even days when we talk about cross-border payments.

Data suggests that around $600 billion cross-border payments are made annually, and the market is projecting a growth of 3% per year. However, traditional payment processing tends to be choppy, highly centralized, and opaque, leading to high fees (commonly 2-3% of transaction value and can go as high as 10%).

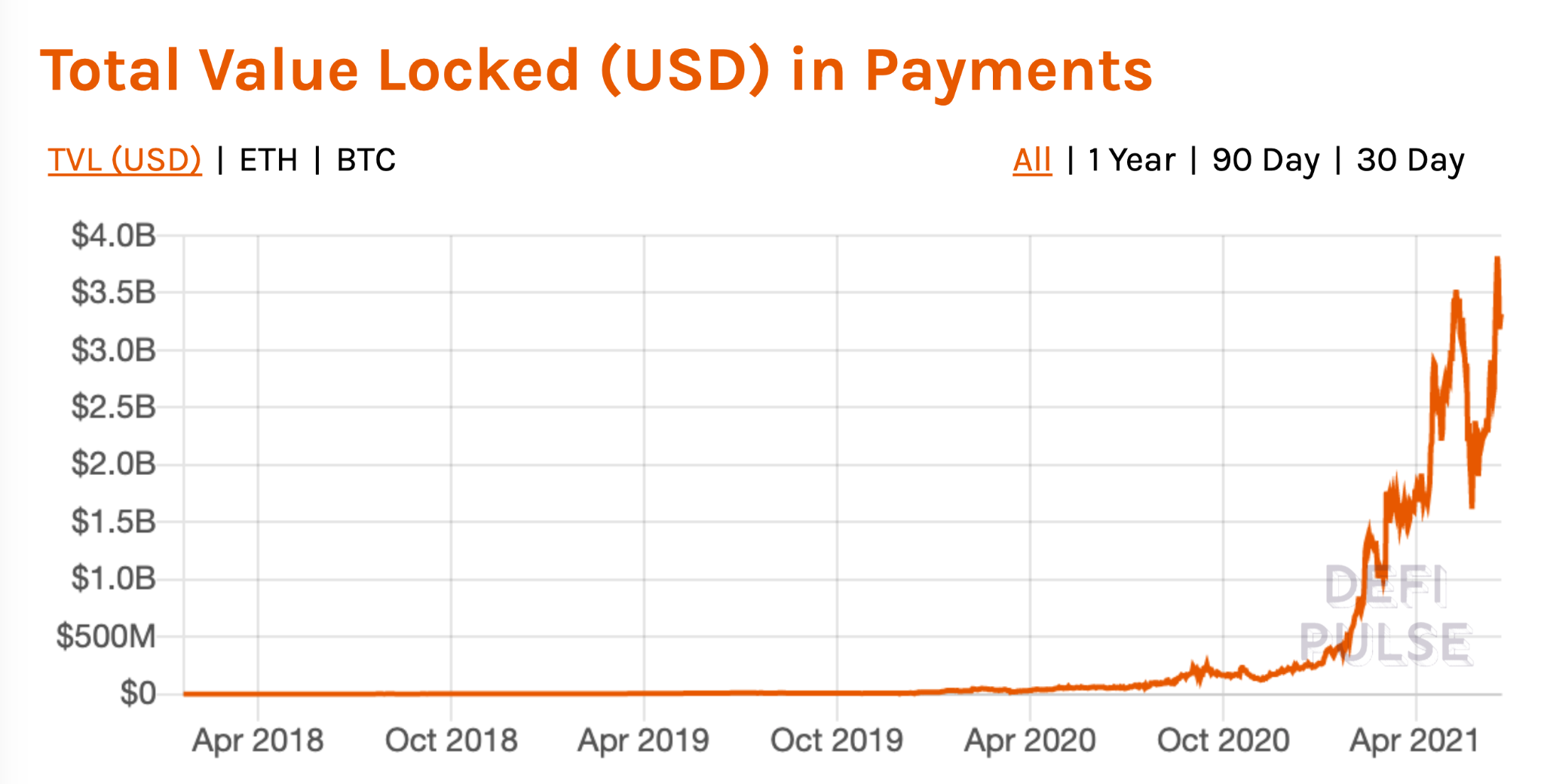

Defi protocols can significantly optimize the process by fixing numerous inefficiencies such as fraud potential, processing speeds, high fees, and risk assessment with its distributed and borderless approach. Some of the notable Defi protocols working towards solving these issues are Aave, Flexa, and xDAI. At its peak this year, the total value locked in Defi protocols dealing with payments surpassed $3.81B.

Although early enthusiasm for DeFi has yet to be mirrored among capital markets, infrastructure firms, and wholesale banks; however, DeFi can greatly optimize the services in cases such as Remittances, KYC/ID fraud prevention, and risk scoring.

Trade Finance

According to the WTO (World Trade Organization), “Some 80 to 90 percent of world trade relies on trade finance (trade credit and insurance/guarantees), mostly of a short-term nature”. Today, Trade Finance serves as the backbone of international trade in goods and services by enabling transactions between buyers and sellers worldwide.

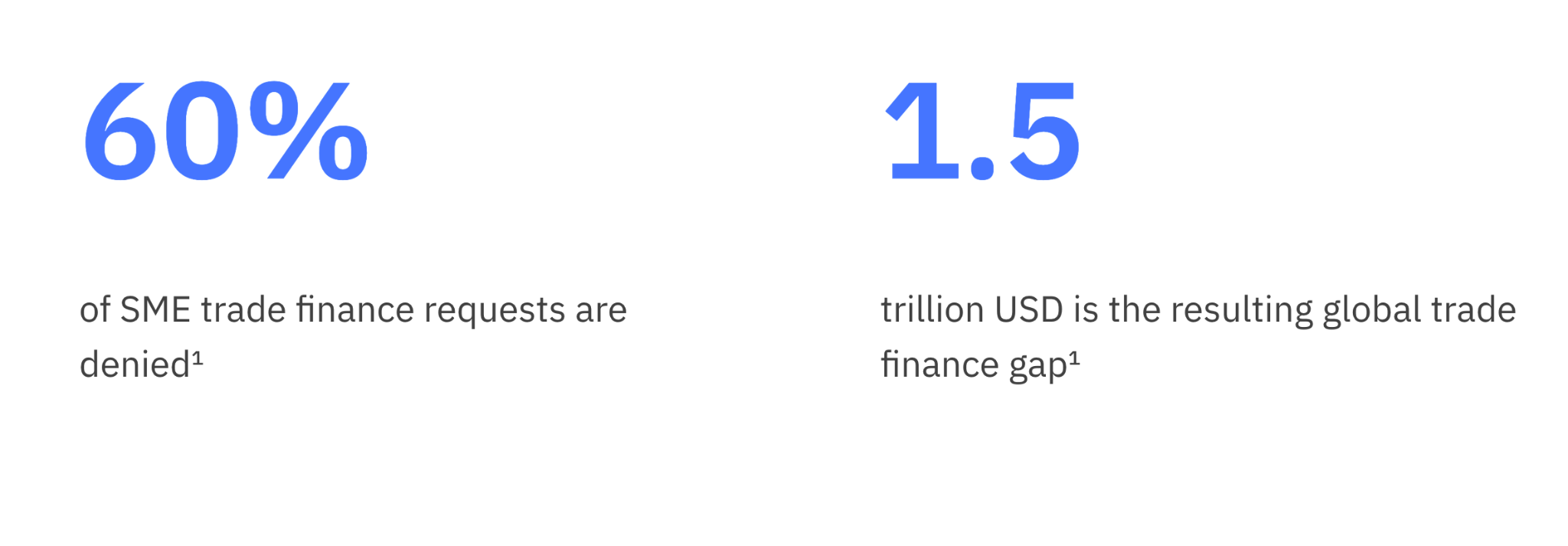

To put things in perspective, Trade Finance is a massive $12T industry, thanks to the globalized world we live in today, where products move across the borders as frequently as we send emails. However, Trade Finance is super complex, as it involves buyers, sellers, banks, insurances, and various intermediaries that finance a trade by facilitating the transactions between buyers and sellers.

Our world runs on trade, and trade finance brings liquidity into international trade, but the infrastructure for trade finance is complex and destabilized, especially for the MSME sector that struggles to secure financing through the traditional banking sector. The process is paper-intensive, insurance companies and banks don’t have complete visibility over the transit of goods, and there is very low collaboration among the stakeholders involved.

Defi platforms can effectively solve these problems and reduce complexity with an open, peer-to-peer, transparent, and collaborative architecture that will add more liquidity and make it easier for the MSME sector to secure financing. One such platform aiming to solve this problem is XinFin, an enterprise-ready hybrid Blockchain technology company that is optimized for international trade and finance.

XinFin platform has launched a product called TradeFinex, a decentralized peer-to-peer platform for Trade Finance originators to distribute deals to a wide range of bank or non-bank funders, uncovering new liquidity pools. TradeFinex supports various key instruments such as Invoices, Letters of Credit, Guarantees, Bills of Lading, and is also compatible and interoperable with the leading trade finance digitization platforms already in the market.

IBM has also developed a tailored blockchain solution to solve the inherent problems of the trade finance space. Built upon the IBM solution is we.trade, a permissioned blockchain platform shared by 15 major European banks. It comes with standardized rules and simplified trading options, with more trading opportunities and less associated risk.

P2P Lending

Peer-to-Peer (P2P) lending is one of the fastest growing segments and is expected to reach $370 billion by 2025 with a CAGR of 5.6%. P2P lending is also called “social lending” or “crowdlending”, where people can secure loans from each other without any bank.

The P2P lending space is dominated by centralized platforms that connect lenders and borrowers with an arbitrage business model, i.e., taking a cut or a commission that ranges between 1-5% of the loan value.

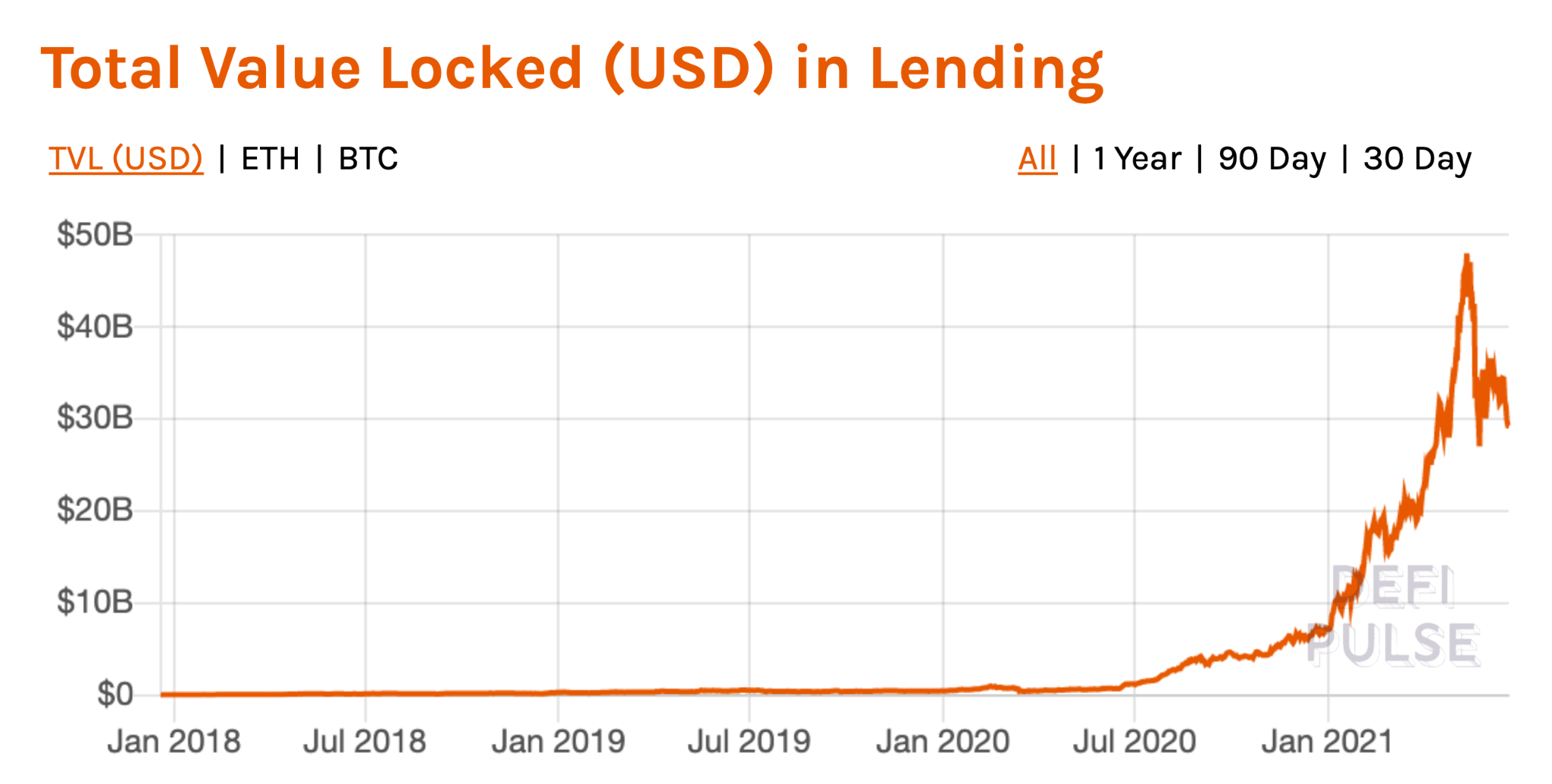

With the inception of decentralized networks and smart contracts, the P2P lending space is evolving very rapidly, where the Defi protocols cut the middlemen (centralized platforms) and offer crypto-backed loans. The borrowers are required to lock collateral which determines how much they can borrow, and lenders contribute to the pool of funds and earn interest based on their share of the pool. The total value locked for lending-based Defi protocols spiked over $47.9B this year at its peak.

The lending Defi protocols such as Compound, Yearn.Finance, and dYdX bring a level of automation that has never been seen before in the P2P lending space. However, all the crypto-backed loans are over-collateralized because it is difficult to assess a borrower’s creditworthiness in a decentralized environment.

Banks can utilize Defi protocols and add creditworthiness through a permissioned blockchain that is interoperable with the public blockchains to enable greater levels of automation, offer a better user experience, and reach more customers.

Conclusion

Defi is still very nascent compared to the size and scope of the traditional finance industry. However, Defi enables many use-cases that can benefit the stakeholders in traditional finance, especially the banks and the institutions involved in “moving money” locally and across the borders. Defi is considered a threat to banks and traditional financial institutions, but as ING said, the best of both worlds is achieved if CeFi and DeFi work in collaboration to create tremendous opportunities for borderless and open finance.