The U.S. inflation rate came in at 8.6% at the end of May, which was the largest annual increase since December 1981. Unfortunately, high prices won’t disappear overnight. Inflation comes down slowly, usually after a period of monetary policy changes by the Federal Reserve. That’s why we’ve seen gradual interest rate increases this year. The hope is that they will mitigate the rapid inflation, and slowly bring prices down to where they should be.

Because inflation isn’t going anywhere just yet, you might need to adjust your financial goals, spending habits and investment strategies. Here are some strategies you can use to stay on track, even as prices continue to rise:

Go Back to Your Budget

As prices increase, it’s particularly important that you’re in the habit of tracking your spending. Spending more on food, gas and just about everything else can add up fast. If you’re not careful, it can start to have a real impact on your cash flow.

To start, try working backwards from your high spending and saving priorities. Make sure you are accounting for the absolute necessities first, like bills and your emergency fund. After that, see where you might need to make adjustments in your everyday spending. You might need to cut back on some of the “extras” you enjoy, plan a more affordable summer vacation, or find ways to drive less to save money on gas.

You will probably have to revisit your budget regularly as prices continue to fluctuate, but that’s a good habit to get into anyway. Here are some tips for managing your budget, even if you hate budgeting.

Also, if you’ve been thinking about making a big purchase like a car or a home, you might want to hold off if you can. You’ll likely end up paying a lot more than you would in a couple years, when the inflation rate has (hopefully) come down.

Keep Calm and Invest

If your investments aren’t where you want them to be, don’t panic. It’s expected that your portfolio will respond to economic changes like inflation.

A balanced portfolio will typically be able to weather turbulent times. Quick, knee-jerk reactions rarely perform well, especially when they’re based on fear or speculation.

That being said, market drops can open up new opportunities that you might not have considered before.

Here are some potentially beneficial moves to consider:

- If you have a lot of cash sitting on the sidelines (above your emergency savings), it might be a good time to start dollar-cost averaging it in.

- If you have any stocks or mutual funds that you’ve thought about getting rid of but they were at a taxable gain, it may be beneficial to sell those and put the proceeds into a stock mutual fund.

- Tax-loss harvesting. It could be a good time to rebalance your taxable investment accounts, especially if you have any mutual funds or ETFs at a loss.

- Back door Roths. If you already do these annually and you haven’t done one for this year, it would be a good time to do so. So far, Congress has not passed anything on the ability to do a back-door Roth for this year.

- You may want to think about converting retirement account money from pre-tax to Roth since the market is low. You will have to pay tax on the amount that you convert, but you get more bang for your buck since markets are lower.

Save Smarter

In order to hedge against inflation, you might need to look for ways to boost your existing savings.

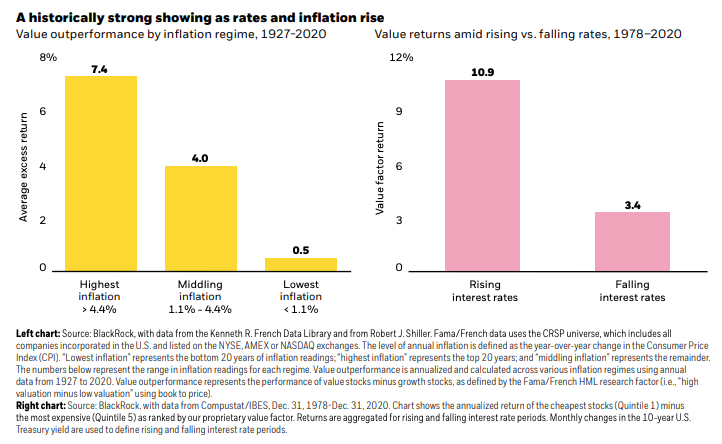

Stocks actually fare pretty well during times of inflation. According to a report from BlackRock, “We believe stocks are one of the best places to be in a rising inflation world. Our review of data back to the 1920s finds that equities perform well as long as inflation isn’t out of control ― over 10%, which is historically rare and not our expectation even in this unusual cycle. In above average inflation environments (5%-10%), value stocks have performed particularly well.”

Another inflation savings tool are savings bonds. Savings bonds are debt securities issued by the U.S. Department of the Treasury. They’re backed by the U.S. government, so they’re considered a generally low-risk investment.

The trouble with low-risk investments is that they can also come with a lower reward. With Savings bonds typically have a rate of return under 2 percent. But right now, the Series I Savings Bond is at 9.62 percent. That rate is only guaranteed for six months – it is subject to change on Nov. 1, 2022.

Series I Bonds are inflation-indexed. You can buy up to $10,000 worth of these bonds each year. I bonds have a fixed rate of interest, which is adjusted for inflation. You can redeem them any time, but if you cash them in within the first five years, you’ll lose the three most recent months’ interest. After five years, you won’t be penalized.

Buying savings bonds is one option to maximize your savings right now. You can learn more about savings bonds here.

About Your Richest Life

At Your Richest Life, Katie Brewer, CFP®, believes you too should have access to financial resources and fee-only financial planning. For more information on the services offered, contact Katie today.

The post Financial Adjustments to Hedge Against Inflation appeared first on Your Richest Life.