We are days out from the next U.S. presidential election, and while we can’t predict the outcome, we can predict that there will likely be a response from the financial markets.

Exactly how the markets will react is less clear, but history has shown us that in times of great change or uncertainty, markets react.

Here’s what might happen as we approach election day, and in the weeks and months after:

Historical Trends: Presidential Elections

Data going back nearly 100 years shows us that market volatility leading up to presidential elections is almost a guarantee.

Since 1928, the U.S. stock market has seen slight dips leading up to the presidential election, averaging a loss of 2.31 percent over the past 10 years. Returns trend upward again in November, continuing to rise through January.

Of course, there are other factors contributing to those numbers, and it can be difficult to separate them out. The Q3 jobs reports and corporate earnings reports, for example, can play into that data during the end of the year.

But when we look at the election year averages, we do see that if there are true impacts from the elections themselves, they tend to be very short-lived.

The Party Difference

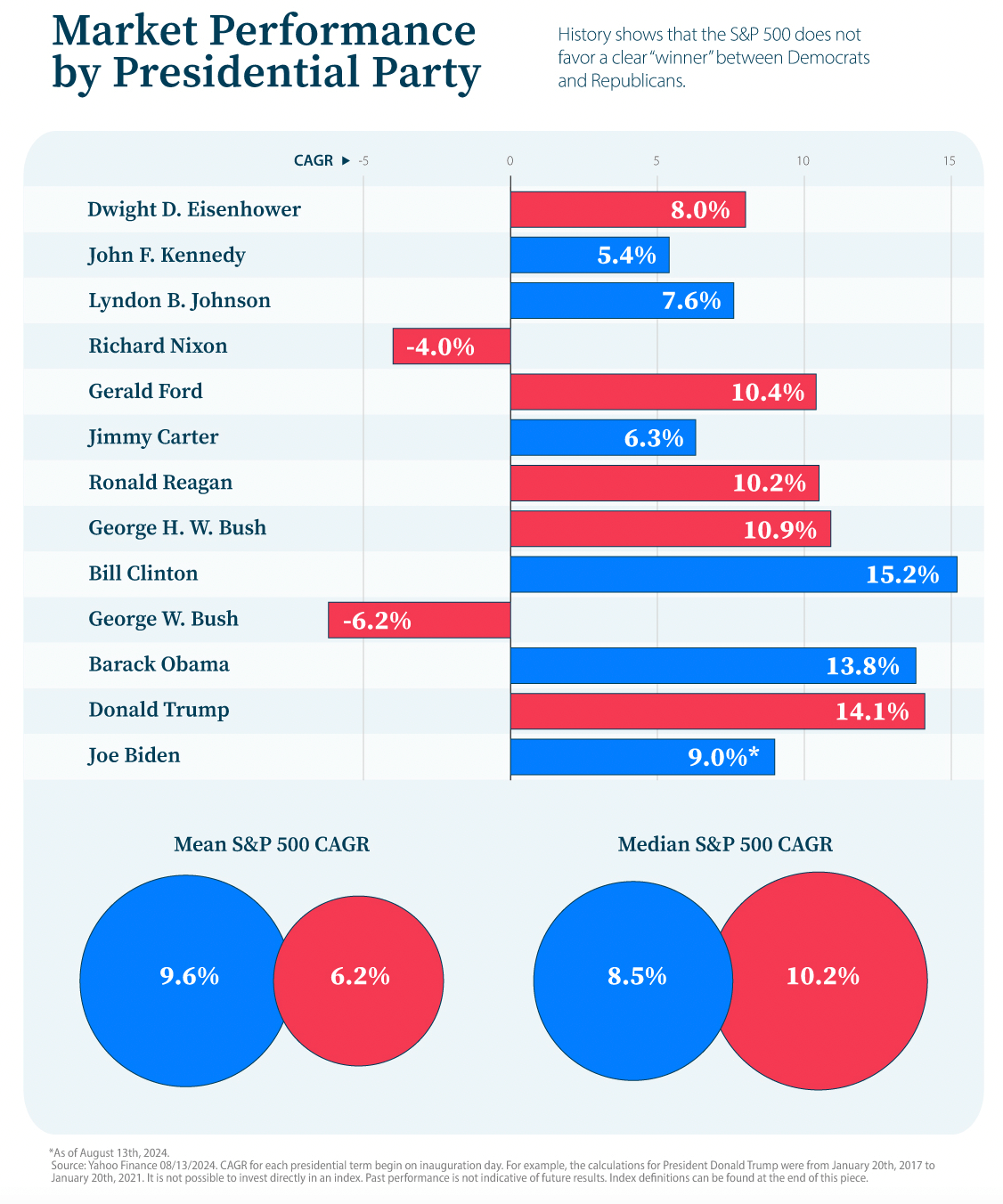

There are some generalizations about how markets react to a democratic versus a republican victory. However, the data shows no real discernible patterns based on a president elect’s party.

Looking back at the compound annual growth rate (CAGR) since Eisenhower was elected, we see very similar return averages for both parties over time.

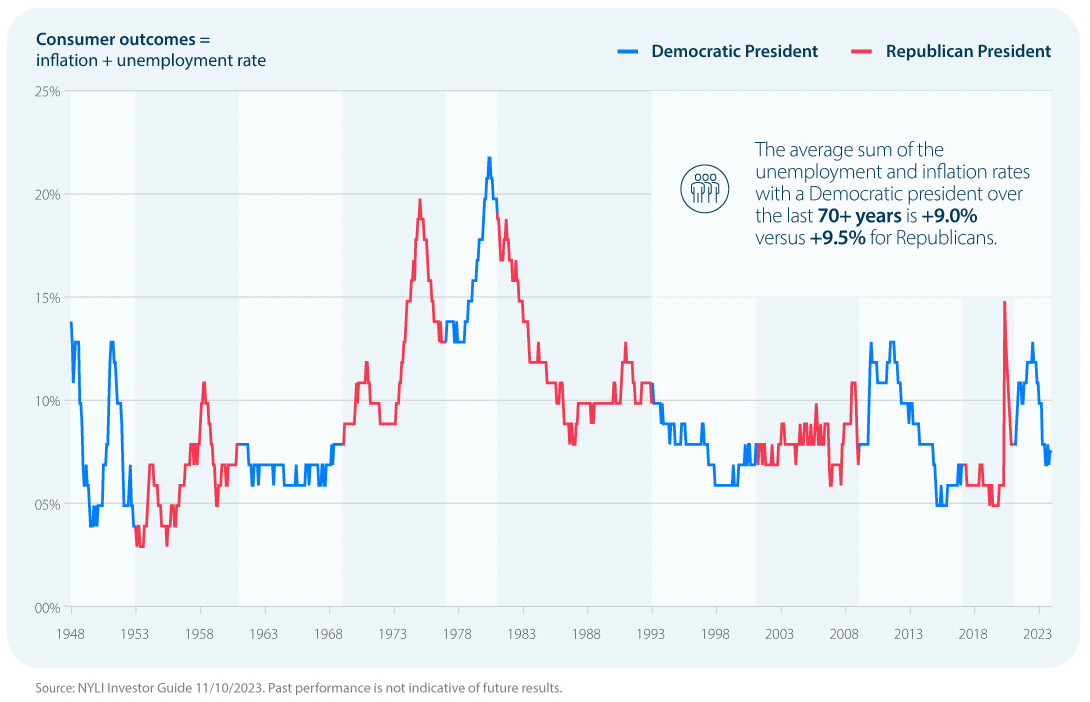

We also see comparable unemployment and inflation rate averages for the past 70 years or so, which means that consumers were not significantly better or worse based on presidential party.

Consumers are typically more affected by factors like changes in the job market, tax laws and interest rates, so those factors could be more important to pay attention to in an election year.

Managing Presidential Elections as an Investor

As an investor, elections can be difficult to navigate. Stock market swings might dominate headlines, and speculation about upcoming changes and policies can run rampant.

These moments are exactly why we lean into more long-term investing strategies. We know the markets get temperamental during elections. We also know that there can be some ups and downs as a new administration gets settled into the presidency.

However, these disturbances tend to be short-lived, and well-balanced portfolios can typically weather them just fine.

Conclusion

While there are historical patterns in how markets perform under different parties, no single election is the same. We are at a unique point in U.S. history where we’re contending with political tensions, rapid technological advances and global unrest, while also coming down from record high inflation and recession concerns.

For investors, understanding these dynamics is crucial for making informed decisions in election years. Focusing on long-term fundamentals and policies can provide a clearer path through the uncertainties of the election cycle.

About Your Richest Life

At Your Richest Life, Katie Brewer, CFP®, believes you too should have access to financial resources and fee-only financial planning. For more information on the services offered, contact Katie today.

The post How Presidential Elections Affect the Financial Markets appeared first on Your Richest Life.