April

2, 2021

4 min read

This story originally appeared on ValueWalk

A Brief History of Life Insurance

Life insurance is a powerful tool in wealth management with a long history dating back to Ancient Rome. Roman soldiers participated in “burial clubs,” in which members pooled resources to help pay funeral costs for the deceased. The actuarial tables used by insurance companies today to help determine policy premium costs have their origin dating back to the 1700s.

Q4 2020 hedge fund letters, conferences and more

Life insurance, like any type of insurance, transfers a catastrophic risk away from you and your family to an insurance company. Here the catastrophic risk is your premature death and the loss of your earnings potential for those you leave behind. Transferring the risk of your premature death with life insurance is the same as transferring the risk of a house fire with homeowners’ insurance.

Term vs. Permanent Life Insurance

When having a conversation about life insurance, it is important to remember that life insurance can help provide:

- Income replacement for a surviving spouse

- Financial support for dependents

- Payment of outstanding debts/final expenses

- Liquidity for estate taxes (if applicable)

You should transfer your risk at the lowest possible cost and via the most efficient methods. That is often provided by the “pure-insurance” offered by a term policy. The term of the insurance and the amount of insurance will depend on what you want the life insurance to provide from the list above.

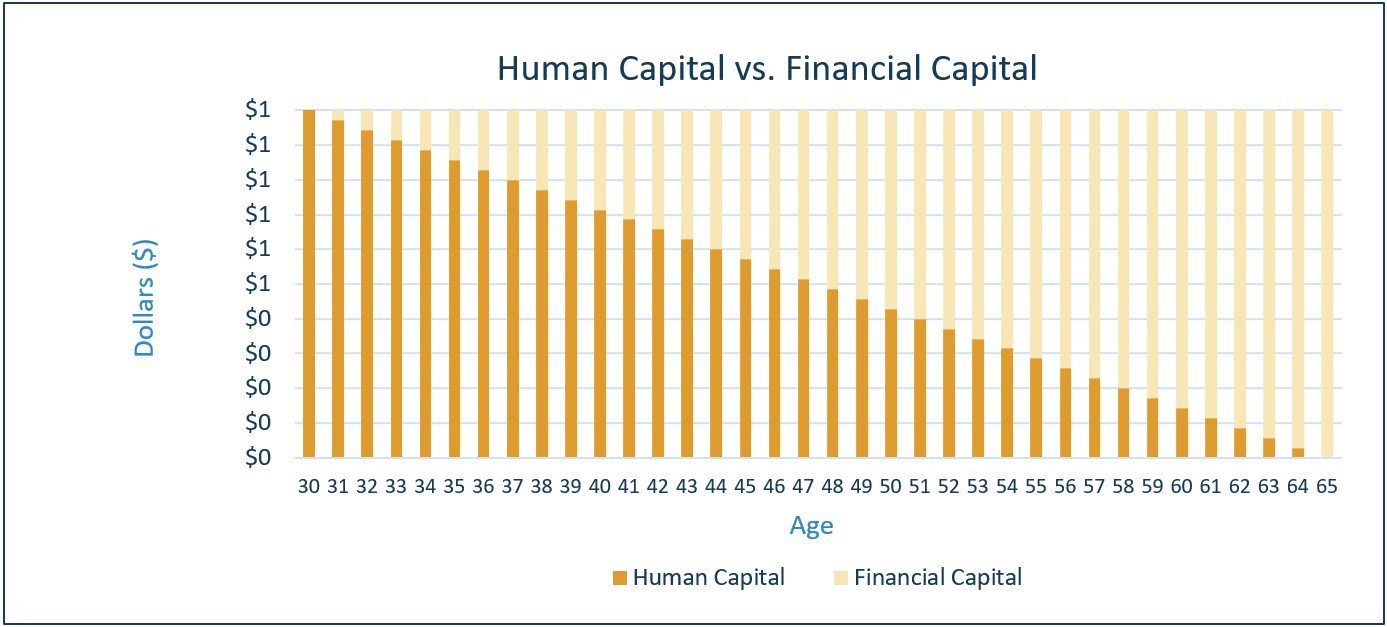

It is important to remember that your income replacement need is temporary – as your career and working years progress, your investment portfolio should grow while your remaining future earned income declines. In other words, your human capital will decrease as your financial capital increases!

This natural life progression makes term insurance the appropriate solution for most life insurance needs. We have previously written about the appropriate amounts of insurance coverage and when permanent insurance could be the right solution, but the focus of this post is how best to structure term insurance coverage once the amount of coverage needed is determined.

“Laddering” Term Life Insurance Policy Coverage

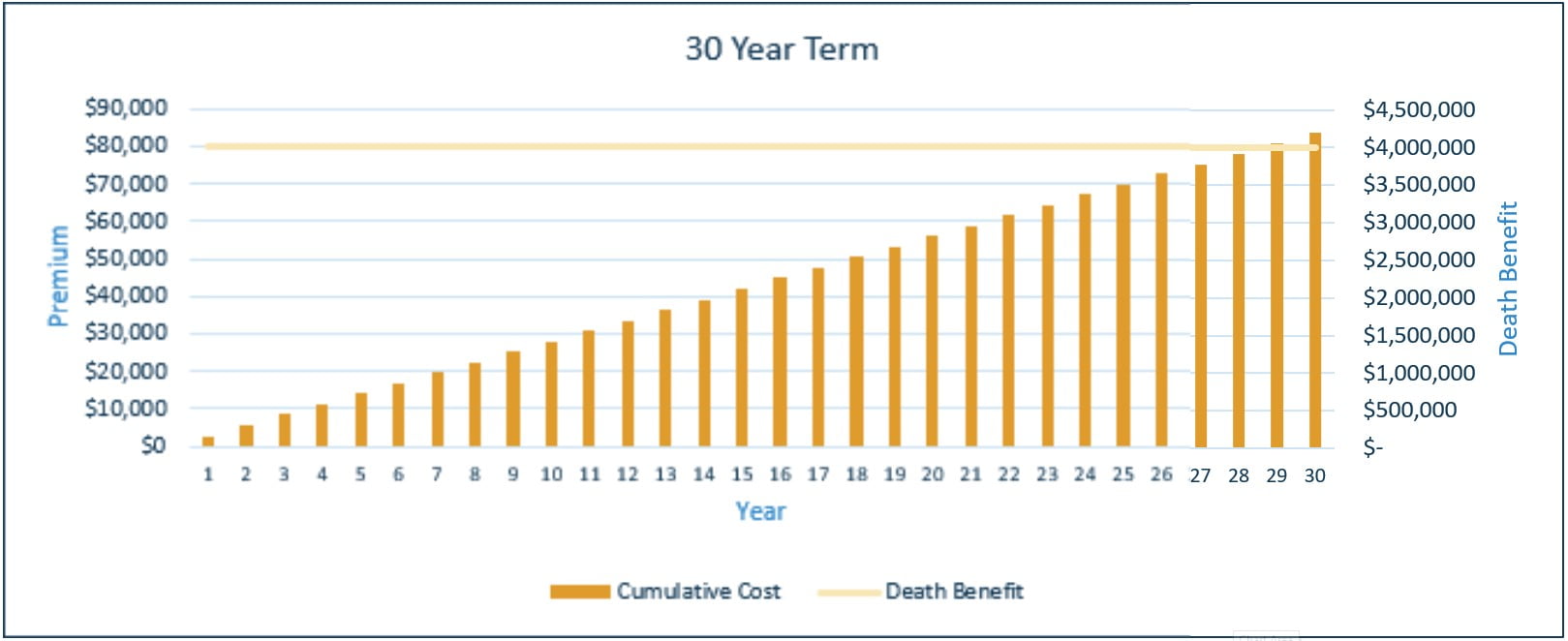

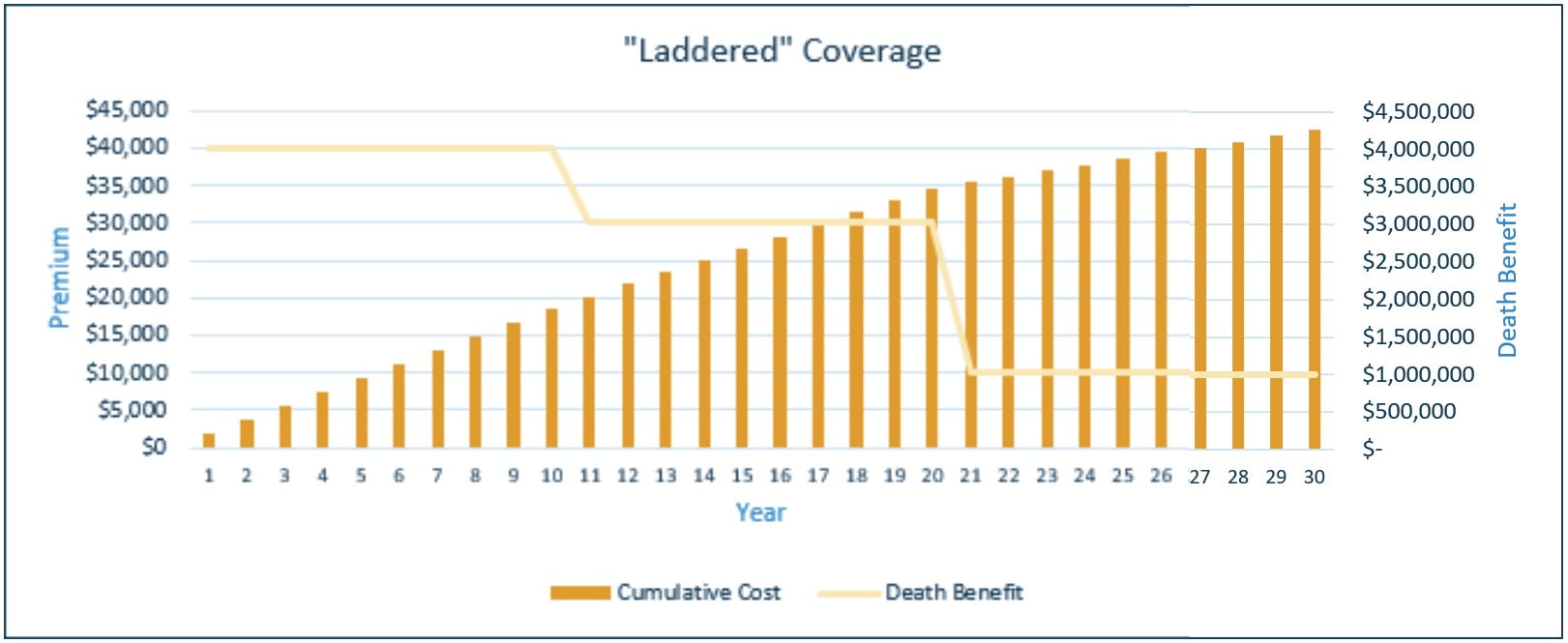

Since most life insurance needs decline with time, term insurance policies can be structured in a way to further save costs. For example, rather than purchasing one 30-year term policy with a $4 million death benefit, you could purchase three separate policies (10-year, 20-year, and 30-year terms) designed to lapse over time totaling the same $4 million in death benefit. This option is commonly referred to as “laddered” life insurance coverage.

Consider Homer, 35, and Marge, 33 who earn a combined salary of $350,000 and have two young children, Bart and Lisa, who are 4 and 2. They want to send Bart and Lisa to college, potentially buy a larger home, and retire at 65. Based on their savings ability and goals, Homer needs $4 million of life insurance coverage today. They work with their life insurance agent and secure a 30-year term quote of ~$2,800 per year for Homer. The cumulative cost of coverage over 30 years is $84,000, shown below:

After conferring with their fiduciary financial advisor, and considering their anticipated savings rates, Homer and Lisa request “laddered” term life insurance quotes: 30-year term for $1 million (~$260 annual cost), 20-year term for $2 million (~$800 annual cost), and 10-year term for $1 million (~$800 annual cost). The total annual cost for all the policies is $1,860, with a cumulative cost of $42,600, shown below:

By structuring their policies in a cost-effective manner, Homer and Lisa can realize annual savings of ~$940 and cumulative savings over 30 years of ~$41,400. Said another way, they can get the life insurance coverage they need for ~50% of the cost!

Conclusion

Laddering term life insurance coverage is a powerful way to reduce costs and ensure you get the most “bang for your buck” from your premium dollars.

Charts Source: https://www.term4sale.com/

Article By Kevin Brady, CFP® and Eric Dostal, J.D., CFP® – Wealthspire Advisors

Wealthspire Advisors LLC is a registered investment adviser and subsidiary company of NFP Corp.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, Certified Financial Planner™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

This information should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The commentary provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use. © 2021 Wealthspire Advisors