Iconic Playboy brand owner PLBY Group (NASDAQL PLBY) stock has been on a parabolic squeeze-like rally up nearly 400% in a matter of months riding the non-fungible token (NFT) hysteria.

Free Book Preview

Money-Smart Solopreneur

This book gives you the essential guide for easy-to-follow tips and strategies to create more financial success.

April

26, 2021

5 min read

This story originally appeared on MarketBeat

Iconic Playboy brand owner PLBY Group (NASDAQL PLBY) stock has been on a parabolic squeeze-like rally up nearly 400% in a matter of months riding the non-fungible token (NFT) hysteria. The Company licenses products under the Playboy brand. Most notably, the Company is pursuing opportunities in the NFT market by selling cryptographic properties of its vast library of iconic photos spanning nearly 70 years. The Company sees this as a potential driver of long-term recurring revenue streams in addition to the existing game plan of expanding Playboy product offerings, reacquiring the licensing rights to online casino gaming, launching sexual wellness products, clothing, cosmetics, cannabis products and more acquisitions. The Company is benefiting of two very strong tailwinds including the value explosion in the collectibles and non-fungible tokens (NFTs) market. The core driver is speculation, which can be fickle and turn on a dime. This stock is thin and extremely volatile with the potential collapse like most special purpose acquisition companies (SPACs) have done. While the Company actually has revenue streams and operates as a business, valuation can be extreme along with risk. With that said, only highly seasoned speculators with the discipline to keep stop-losses should only consider monitoring deep opportunistic pullback levels to play.

Q4 2020 Earnings Release

On March 23, 2021, PLBY Group released its fiscal fourth-quarter 2020 results for the quarter ended December 2020. The Company reported a net loss of (-$0.5 million). Revenues grew 118.1% year-over-year (YOY) to $46.33 million, beating analyst estimates for $35.84 million.

Conference Call Takeaways

PLBY CEO, Ben Kohn, articulated, “Simply speaking, Playboy is huge. Our massive global reach drives $3 billion of consumer net spend, with products sold in over 180 countries. We engage with millions of people every day across our own channels and social media, and our reach continues to grow with our built-in network of ambassadors. No brand gets noticed quite like the Rabbit Head and in today’s increasingly cluttered, fickle environment, Playboy has a special power to both stand out and last.” He went on to outline the two main revenue models, direct-to-consumer (DTC) and licensing. The four categories of focus are on Sexual Wellness, Style & Apparel, Gaming & Lifestyle and Grooming. The Company plans to build out its flagship playboy.com “into a lifestyle shopping experience” that cross-sells across Company-owned Yandy and Lovers Destination labels.

Licensing and NFTs

Playboy is currently one of the top 20 most licensed brands worldwide. China is a growth market both in terms of licensing but also in enforcing trademarks and capturing unauthorized sales. The Company has collaborated with key influencers in the Chinese fashion industry launching lines of women’s apparel. The Company plans to pursue NFTs of its “priceless’ library of art and photography, which it projects to have a long runway generate recurring revenues. The Company has passed on many previous proposals for licensing NFT, as it contemplates opportunities to harvest not only its iconic archives but also create new “kind of ownable experiences with our talent.”

Analyst Upgrades

On March 24, 2021, Roth Capital reiterated PLBY Group Buy rating with a raised target of $26 per-share. On March 31, 2021, Canaccord Genuity initiated coverage with a $28 price target citing the direct-to-consumer (DTC) channel as the main growth driver. The current run up in shares is powered by the NFT craze even before the Company has actually offered NFTs of its over 5,000 piece of art, covers, photography as well as special commissioned pieces with artists like LeRoy Neiman and Andy Warhol. The Company has partnered with Nifty Gateway, an online NFT marketplace, to potentially monetize it’s archives as well as create new digital assets. Arguably the art NFTs are in a bubble similar to the initial coin offering (ICO) boom and bust as regulatory agencies cracked down on them. A similar fate is possible as regulatory and tax agencies clamp down on cryptocurrencies and very like NFTs. PLBY stock may also be influenced by the sales of its NFTs once they launch and any sales that make headlines can impact shares.

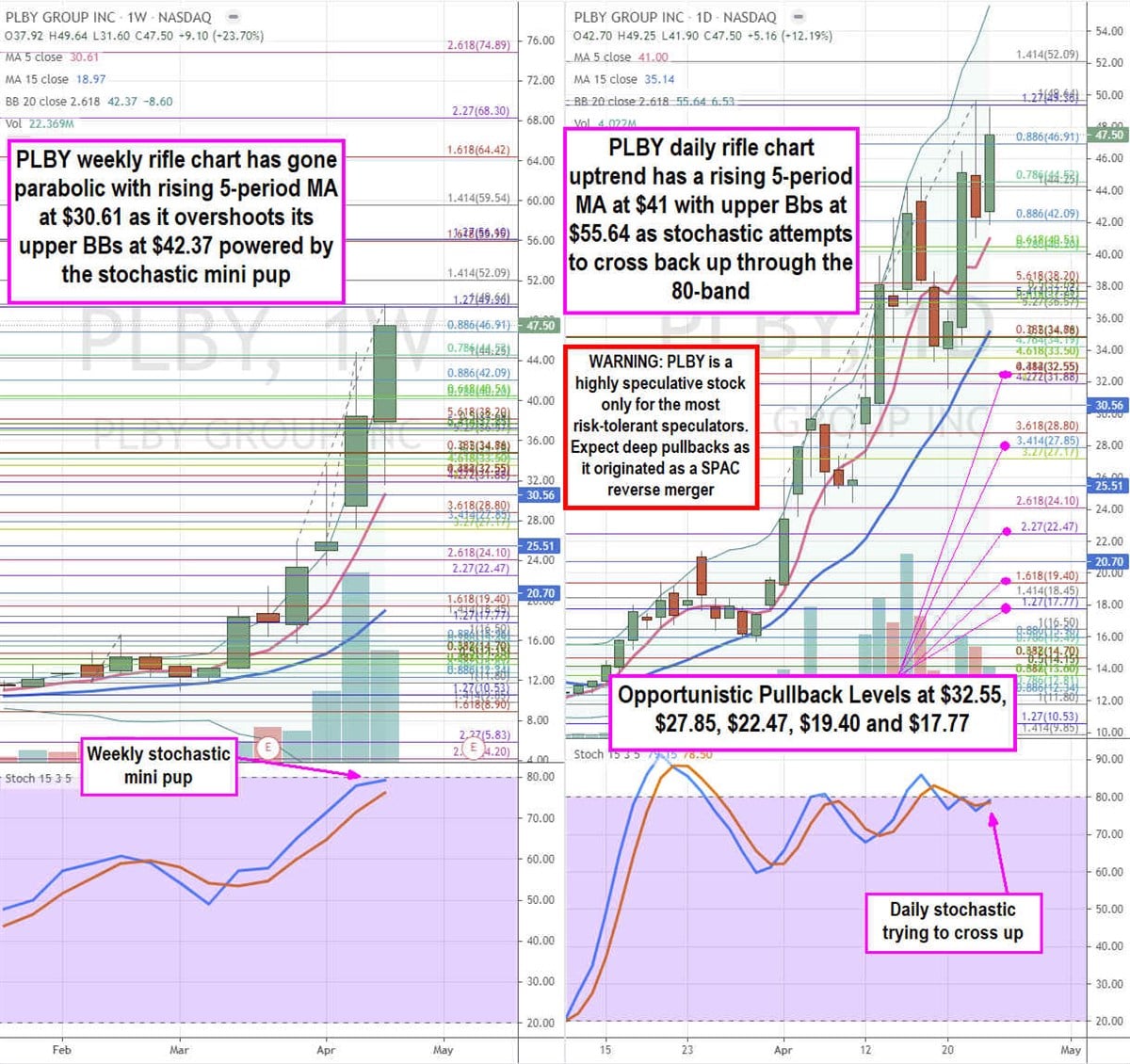

PLBY Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for PLBY stock. PLBY is a thinly traded high-risk speculative stock that only the most risk-tolerant and nimble speculator should even consider trading. The stock has a miniscule 12 million share float with thin liquidity. The weekly rifle chart uptrend overshot its upper Bollinger Bands (BBs) at $42.37 hitting initial peaks at the $49.64 Fibonacci (fib) level. The weekly uptrend has a rising 5-period moving average (MA) at $30.61 and a weekly 15-period MA all the way down near the $19.40 fib. The weekly stochastic has a mini pup nearing the 80-band. The daily rifle chart formed a market structure low (MSL) triggered down at the $17.77 fib breakout. The daily rifle chart has a pup breakout with a rising 5-period MA at $41 and upper BBs near $55.64. Opportunistic pullback levels start at the $32.55 fib, $27.85 fib, $22.47 fib, $19.40 fib, and the $17.77 fib. Don’t hesitate to keep stop-losses to avoid being a bagholder. Since this stock was a SPAC business combination, be aware that it can implode like most SPAC high fliers and NFTs can collapse like ICOs.

Featured Article: Municipal Bonds