June

10, 2021

8 min read

This story originally appeared on ValueWalk

El Salvador made twitter trends, media headlines, and front-page mentions during the 2021 Bitcoin Conference when President Nayib Bukele introduced his plans and intentions to crown bitcoin as a legal tender in the country.

Q1 2021 hedge fund letters, conferences and more

The country had seen similar trends in its past when El Salvador replaced its native currency, the colón, with the U.S. Dollar twenty years ago. Seeing the president pushing for modern digital gold does not seem surprising. It may or may not be an equally drastic step for the country’s financial future.

El Salvador officially crowned Bitcoin as its legal tender on an early Wednesday vote, with 62 of the total 84 lawmakers approved President Nayib Bukele’s proposal for the Latin American country to adopt Bitcoin.

The Salvadoran president’s vision surrounding Bitcoin was proposed as an effort to boost financial inclusion in a country where only a third of the population has access to financial services. Bitcoin’s mass adoption in the country will allow the population to gain financial freedom from centralized institutions as they won’t necessarily have to use a government wallet.

Moreover, the Salvadoran president also announced to grant permanent residency to individuals who invest three Bitcoins into the Salvadoran Economy. The novel bill introduced a mandate where all businesses in the country have to accept Bitcoin for goods and services. Additionally, the president’s government has announced to support organizations that are hesitant in taking the risk and shifting towards accepting the volatile asset.

The president aims to provide support by setting up a trust at the Development Bank of El Salvador where entities can instantly convert their Bitcoins to the country’s fiat currency, the U.S. dollar. The trust is expected to hold about $150 million to provide aid to entities that are afraid of the risk inherent in digital currencies.

This trust will allow merchants who don’t want to risk making the shift but have to accept bitcoin as the mandated currency to get dollars deposited into their accounts whenever they make a sale. The government will provide aid to hesitant merchants to instantly exchange their bitcoins for dollars.

Furthermore, with the Bitcoin Law successfully crowned in the country, Government officials plan to meet with officials from the International Monetary Fund (IMF) to discuss their financial plans. With hopes of Bitcoin being a successful step for the country, the Salvadoran president also announced his plans to promote Bitcoin mining in the country. With El Salvador already in talks with various businesses with excess geothermal energy, the mining industry could greatly benefit globally.

Public and Expert Opinion

When Bitcoin’s white paper was introduced in 2009, it was introduced to establish an alternative but better financial system. Since its introduction, Bitcoin has been striving to break into mainstream adoption; however, it has only recently seen an increase in adoption thanks to its rise in value and awareness.

Although Bitcoins and cryptocurrencies expected first-world countries to lead the narrative and movement for a decentralized ecosystem, seeing Central America do it instead has much of the same effects. Social media users praised the shift to decentralized finance from the Latin American nation with slogans such as De-Central America.

El Salvador’s step towards financial freedom could be followed by Paraguay, Panama, Brazil, and other Latin American countries. Paraguay is currently working on a proposal to accept Bitcoin and other cryptocurrencies in the country. Moreover, leading crypto projects such as Cardano and Algo are working in parts of Africa as it advocates for financial inclusivity.

Recently, Bitcoin has also seen mainstream adoption in other parts of the world, such as Ukraine and Sweden. Interestingly, Ukraine and Sweden are some of the best European governments when it comes to digital currencies, so much so that both Ukraine and Sweden have introduced central-backed digital currencies.

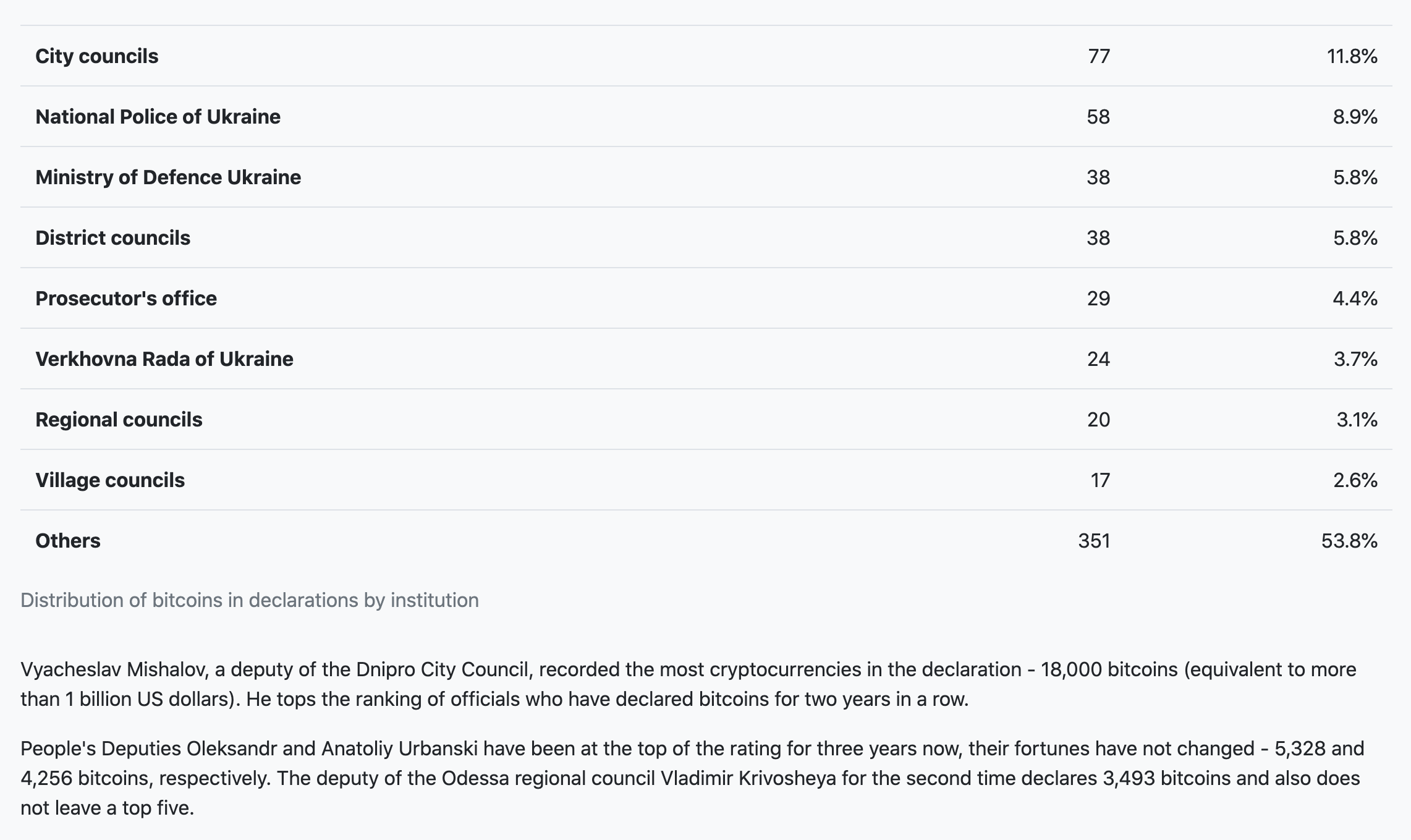

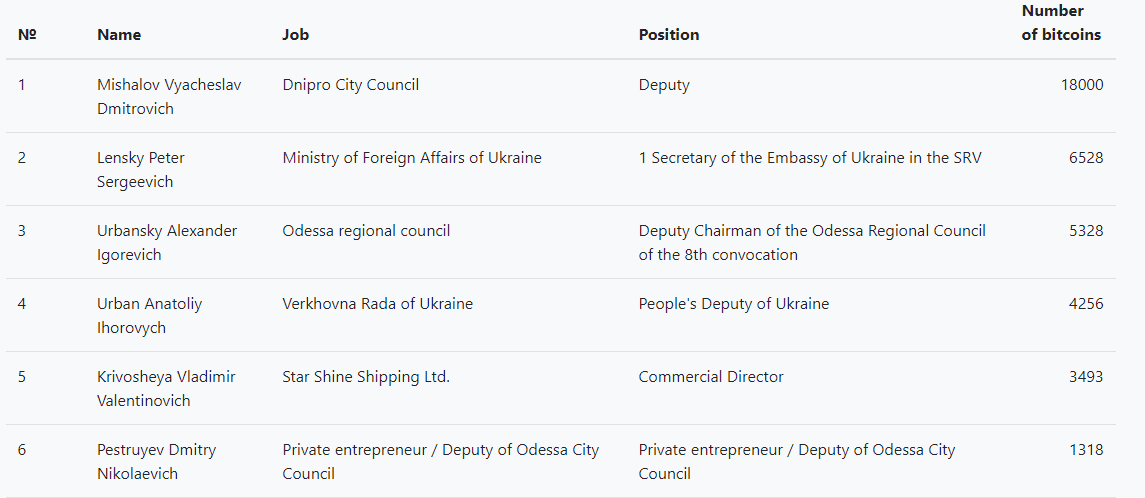

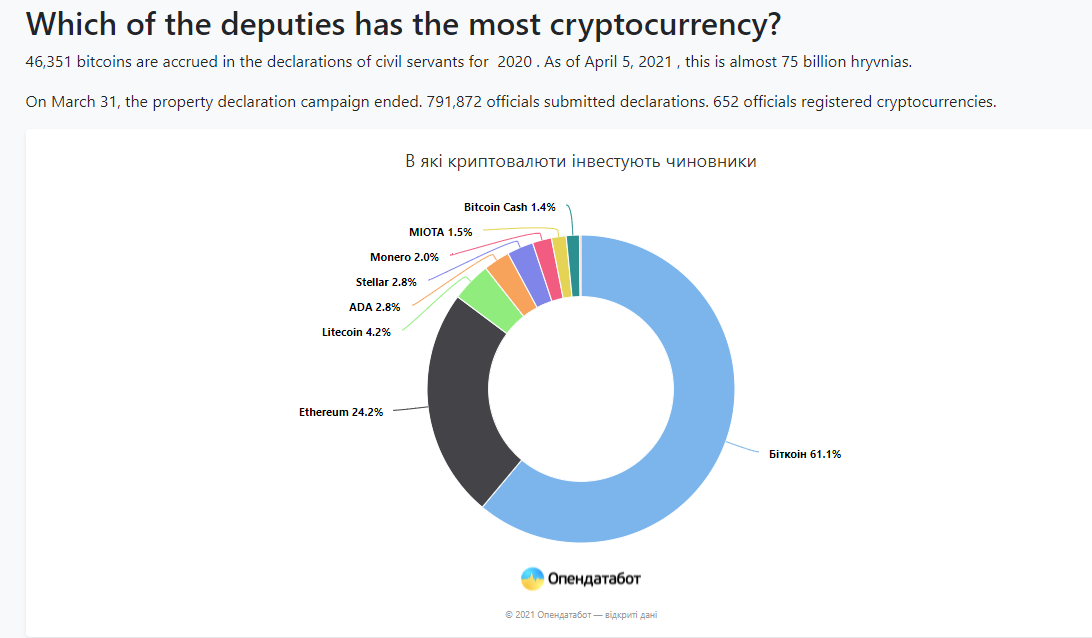

According to a report by the Ukrainian Government, public officials declared ownership of over 46,000 BTC.

The Ukrainian government data transparency provider, Opendatabot, established that civil servants in the country owned over $2.6 billion worth of Bitcoins, with the largest number of owners working in city councils, the ministry of defense, and the national police. The report stated that Mishalov Vyachelav Domitrovich owns over 18,000 BTC or approximately $1 billion worth of Bitcoin. Although Bitcoin has not yet seen mainstream adoption in the country, it is expected to be embraced by the government sooner than later.

Seeing the recent crash in the crypto prices surrounding market manipulation from Billionaire celebrities and governments, the adoption from El Salvador could act as the savior for the market. It’s kind of funny when El Salvador quite literally means the Republic of the Saviour.

The Salvadoran President’s proposal was lauded by the crypto community around the world. Many crypto enthusiasts, public officials, and crypto celebrities shared their support for the bill by applying the laser eye filter to their profile pictures.

Interestingly, a majority of the crypto community also started a trend #LASERRAYUNTIL100K following the Salvadoran President’s successful bill. However, not everyone shares the same feelings towards the President’s intentions. The Salvadoran president is notorious for corruption, leading some to worry if Bitcoin will end up widening the financial gap by enriching and powering a government that has infamously shown authoritarian tendencies.

Some users on Twitter even shared their disagreement with the bill in the following tweet.

What’s next for the Salvadoran People?

Considering the economic and political unrest in El Salvador, there’s a very strong use case for Bitcoin. El Salvador has numerous characteristics that have made Bitcoin an exemplary asset for the Latin nation.

The Bitcoin law also means that the Salvadoran population will have to learn how to access various asset management tools and digital wallets. Considering only one-third of the population has access to financial services, it’s hard to forecast how the shift will be. It’s important to note that a majority of the Salvadoran population has already been using the lightning network for quite a bit of time now.

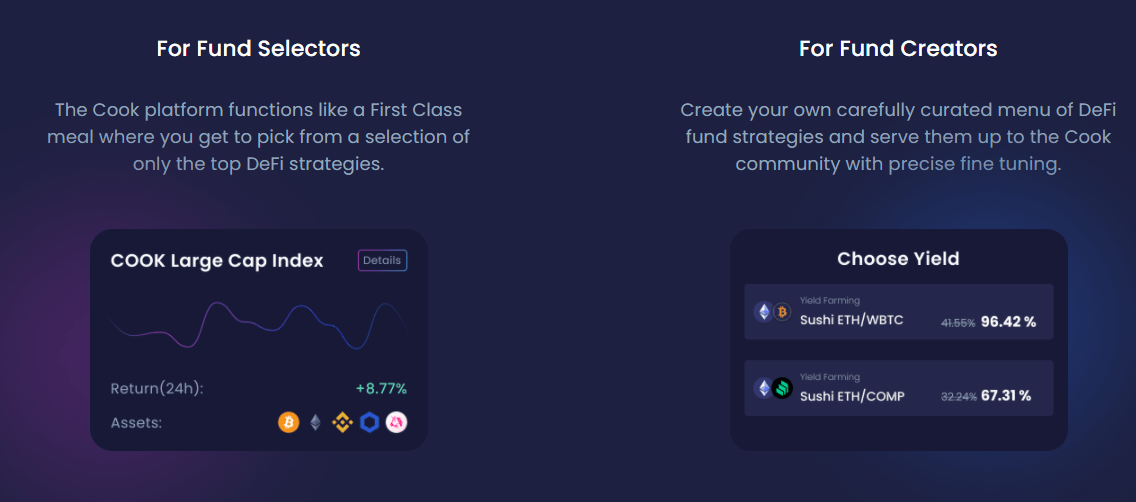

Interestingly, asset management tools such as Cook Finance may seem like a great option. Cook Finance is an open, transparent, and decentralized protocol that allows investors with exclusive investment choices and provides trustworthy fund managers’ trading capabilities.

Moreover, digital wallets such as CoinSpace are some of the ideal options in the market advocating for instantaneous Bitcoin transactions with a seamless UI. Currently, Coinspace has over 20 million wallets and has some of the lowest fees in the industry. Other options such as Electrum, BRD, and Edge are also great options that provide easy-to-use interfaces for newer users.

Bitcoin adoption has seen a lot of success in countries such as Nigeria and Venezuela, where bitcoin is used to process remittances instantly while providing a way for people without the means of opening a bank account to access financial services through their smartphones.

According to the World Bank, El Salvador’s dollarized economy is heavily dependent on international remittances. It made up over $6 billion in 2019, which is nearly a fifth of the country’s GDP.

Moreover, according to another World Bank report, only one-third of the Salvadoran population have access to a local bank account. The introduction of the Bitcoin law means that the Salvadoran people can finally open up digital wallets and instantly send or receive money.

According to a report, over one million Salvadoran immigrants who reside in the U.S. send remittances back home to their families. The introduction of the Bitcoin law and the inherent advantages such as access to a myriad of digital wallets means that more people can access financial services.

Conclusion

As the crypto market expands and develops, El Salvador’s forward-thinking steps could greatly benefit Bitcoin’s mass adoption. A majority of the Latin American population does not have access to financial services and bank accounts. With the introduction of decentralized digital currencies to the continent, these countries could bring about a historic revolution of financial freedom and empowerment.

El Salvador’s embracement could be just the start of a domino effect that Bitcoin has been aiming for. With neighbors such as Paraguay, Brazil, and Panama planning to make a similar move, Bitcoin could change the world sooner than later.

Author the Author

Haroon Baig is an Ex-Microsoft hire, a coding geek turned freelance researcher and writer at Decentralised Lab. He works with companies of every size in the blockchain space to establish, expand, and improve their online footprint through his writings. He got involved in the crypto space back in 2012 and was fascinated by the underlying technology. Since then, He has been educating people about this space through his content.