Video game maker Take-Two Interactive Software (NASDAQ: TTWO) stock is attempting to rally off its recent lows as post- pandemic tailwinds underscore…

Free Book Preview

Money-Smart Solopreneur

This book gives you the essential guide for easy-to-follow tips and strategies to create more financial success.

June

30, 2021

5 min read

This story originally appeared on MarketBeat

Video game maker Take-Two Interactive Software (NASDAQ: TTWO) stock is attempting to rally off its recent lows as post- pandemic tailwinds underscore the stickiness of interactive online gaming. Known widely for its Grand Theft Auto (GTA) franchise, the return to normal trend is not affecting the continued growth of engagement in its massive open-world game Grand Theft Auto V. Record-breaking monthly active users (MAUs) and metrics continue to show expansion even as the return to normal continues. The resurgence of mods like role-play (RP) is a powerful tailwind that has shown to spur more interest and growth. RP is a modified version of GTA 5 where users can play as a regular character in GTA 5 and modify them. The engagement between characters is hilarious and is often monetized in videos on Twitch and YouTube (NASDAQ: GOOG). The Company has also mapped out its strongest pipeline of releases ever with 21 titles scheduled to launch in fiscal 2022. While everyone awaits the release of Grand Theft Auto 6 (GTA 6), there’s enough downloadable content (DLC) to keep the near-decade-long franchise growing as its top seller with over 145 million copies sold equating to nearly 42% of total revenues for the GTA lineup. One can only assume the rollout of GTA 6 will be the hottest videogame in history. The Company has planned on launching a GTA 5 remaster on Nov. 11, 2021 for next-gen consoles PlayStation 5 (NYSE: SONY), and Xbox Series X (NASDAQ: MSFT), which is literally guaranteed to spike sales. On the flip side, the reliance on the GTA franchise makes investors nervous with any downtick in engagements. The Company is working to bolster its other franchises in the meantime as investors await any news on GTA 6. Prudent investors can monitor opportunistic pullbacks to scale in a position on Take-Two Interactive stock.

Video game maker Take-Two Interactive Software (NASDAQ: TTWO) stock is attempting to rally off its recent lows as post- pandemic tailwinds underscore the stickiness of interactive online gaming. Known widely for its Grand Theft Auto (GTA) franchise, the return to normal trend is not affecting the continued growth of engagement in its massive open-world game Grand Theft Auto V. Record-breaking monthly active users (MAUs) and metrics continue to show expansion even as the return to normal continues. The resurgence of mods like role-play (RP) is a powerful tailwind that has shown to spur more interest and growth. RP is a modified version of GTA 5 where users can play as a regular character in GTA 5 and modify them. The engagement between characters is hilarious and is often monetized in videos on Twitch and YouTube (NASDAQ: GOOG). The Company has also mapped out its strongest pipeline of releases ever with 21 titles scheduled to launch in fiscal 2022. While everyone awaits the release of Grand Theft Auto 6 (GTA 6), there’s enough downloadable content (DLC) to keep the near-decade-long franchise growing as its top seller with over 145 million copies sold equating to nearly 42% of total revenues for the GTA lineup. One can only assume the rollout of GTA 6 will be the hottest videogame in history. The Company has planned on launching a GTA 5 remaster on Nov. 11, 2021 for next-gen consoles PlayStation 5 (NYSE: SONY), and Xbox Series X (NASDAQ: MSFT), which is literally guaranteed to spike sales. On the flip side, the reliance on the GTA franchise makes investors nervous with any downtick in engagements. The Company is working to bolster its other franchises in the meantime as investors await any news on GTA 6. Prudent investors can monitor opportunistic pullbacks to scale in a position on Take-Two Interactive stock.

Q4 Fiscal 2021 Earnings Release

On May 18, 2021, Take-Two released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported an earnings-per-share (EPS) profits of $1.88 beating analyst estimates for $0.98, by $0.90. Revenues rose 7.6% year-over-year (YoY) to $784.63 million beating $666.11 million consensus analyst estimates. GAAP net revenues were up 10% to $839.4 million compared to $760.5 million in the Q4 fiscal 2021 versus Q4 fiscal 2020 period. Annual GAAP net revenues rose 9% tot $3.373 billion. Net income grew by 46% to $588.9 million or $5.09 per diluted share. Recurrent consumer spending rose 38% YoY accounting for 67% of total GAAP net revenue. The largest drivers of GAAP net revenue in Q4 was NBA 2K21, NBA 2K20, Grand Theft Auto Online, Grand Theft Auto V, Red Dead Redemption 2, Red Dead Online, Social Point’s mobile games, Sid Meir Civilization VI, Borderlands 3 and NBA Online. Net bookings is defined as the net number of products and services sold digitally or sold-in physically during the period including licensing fees, merchandise, in-game advertising, strategy guides and publisher incentives. Total Net Bookings rose 8% to $784.5 million for Q4 and 17% YoY.

Forward Guidance

Incidentally, the Company provided fiscal 2022 revenue guidance but using GAAP metrics rather than the non-GAAP analyst estimates, making comparisons difficult. Take-Two issued Q1 fiscal 2022 GAAP revenues of $730 to $780 million, The Company issued full-year fiscal 2022 GAAP revenues between $3.14 billion to $3.21 billion.

Conference Call Takeaways

Take-Two Interactive CEO Straus Zelnick set the tone, “Customer engagement with NBA 2K remains incredibly strong with more than 2.3 million users playing the game daily. We see a significant opportunity to grow the franchise further as we provide unique and innovative experiences throughout the game.” He continued, “Once again, Rockstar Games’ iconic Grand Theft Auto series exceeded our expectations, expanded its audience and set new benchmarks in fiscal 2021. Driven by an array of new free content updates and sustained interest in last holiday’s Cayo Perico Heist, Grand Theft Auto Online benefitted from the strongest engagement trends during the fourth quarter, including a record number of active players and second-highest quarter of recurrent consumer spending on record.” He noted that full-year participation levels hit all-time highs for both new and returning players as spending grew 31% YoY. GTA 5 has sold more than 145 million copies to date. He concluded, “… in fiscal 2022, we plan to deliver an exciting array of offerings, including four immersive core releases from proven and new franchises. With the strongest pipeline in our Company’s history, including many new releases planned for fiscal 2023 and 2024, we highly optimistic about our growth trajectory and we will be making significant investments this year to enhance our enterprise in key areas such as creative talent, IT, and other infrastructure.”

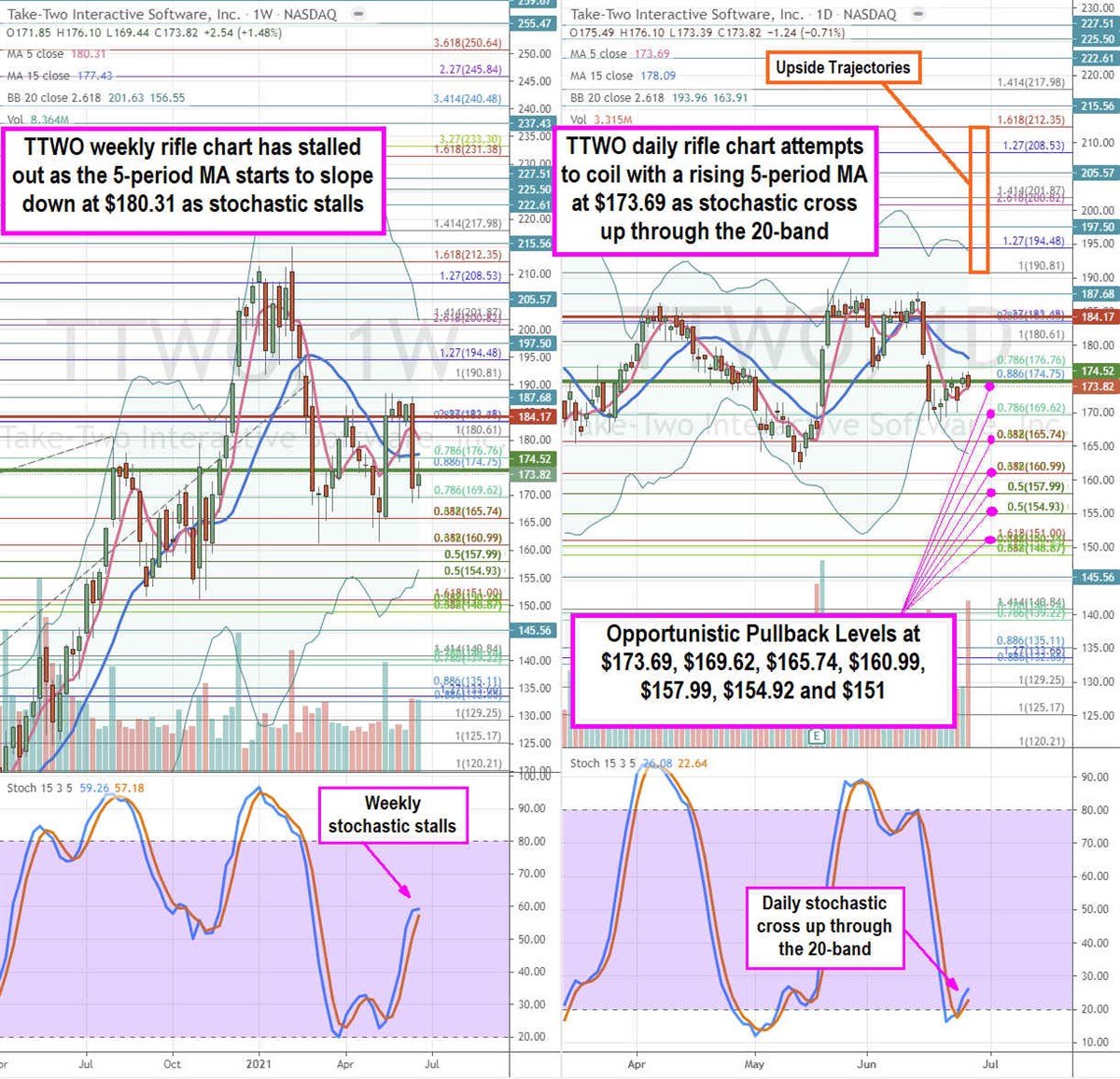

TTWO Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the playing field for TTWO shares. The weekly rifle chart rug pulled from $187.68 to the $169.62 fib Fibonacci (fib) level before staging a rally attempt. The weekly 5-period moving average (MA) sits at the $80.61 fib with the 15-period MA at the $177.76 fib. The weekly stochastic stalled at the 60-band. The weekly market structure low (MSL) buy triggers above $173.82. The weekly upper Bollinger Bands (BBs) sit at the $201.82 fib. The daily rifle chart is attempting to rally as the 5-period MA rises at $173.69 as it attempts a channel tightening to the daily 15-period MA at the $178.09. The daily stochastic is attempting a crossover back up through the 20-band. Prudent investors can monitor for opportunistic pullback levels at the $173.69 daily 5-period MA, $169.62 fib, $165.74 fib, $169.99 fib, $157.99 fib, $154.92 fib, and the $151 fib. The upside trajectories range from the $90.81 fib up towards the $212.35 fib level.

Featured Article: Growth Stocks, What They Are, What They Are Not