June

23, 2021

6 min read

This story originally appeared on StockMarket

3 Tech Stocks To Watch Ahead Of July 2021

Tech stocks are heating up with the Nasdaq Composite powering to a record high. Compared with the S&P 500 and the Dow, the Nasdaq Composite was the relative outperformer, hitting a new intraday all-time high. The bullish sentiment came after Powell reiterated that inflation pressures will be temporary. With Big Tech companies such as Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN) bouncing back from sharp sell-offs to continue a dramatic surge, investors are on the lookout for top tech stocks in the stock market that may still be worth buying.

At a time when innovation is the name of the game, it comes as no surprise that the best tech stocks continue to grow. This demonstrates that investors are still keen on new and relevant technologies. Admittedly, there may have been ongoing rotation to cyclical stocks. But growth stocks may be clawing back some of the much-deserved attention in the stock market today.

According to Barclays head of U.S. equity strategist Maneesh Deshpande, “We believe market leadership is likely to change from cyclical to secular growth stocks as the Covid recovery trade has mostly run its course. Secular growth stocks look favorably positioned to benefit from the digital transformation that got accelerated during Covid.” If anything, the tech industry is constantly bringing out new products and the need for updates to existing ones is always palpable. With all that in mind, if you are looking beyond Big Tech, do you have these tech stocks on your watchlist today?

Top Tech Stocks To Buy Now [Or Sell] Now

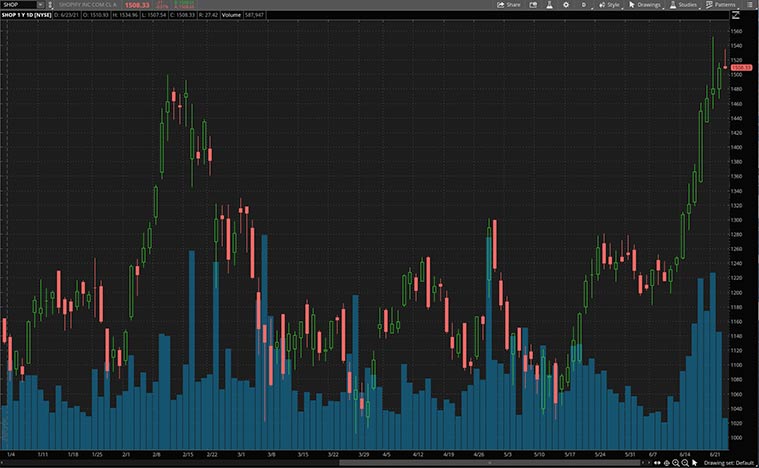

Shopify

E-commerce platform specialist Shopify has been trending in the stock market recently. Not only has the e-commerce titan rebounded from the sell-offs earlier this year, but its stock price also hit an all-time high this week. This shouldn’t come as a surprise considering Shopify helps retailers go digital via its e-commerce platform and retail point-of-sale systems. Today, the company’s platform is home to over 1.7 million businesses from 175 countries across the globe. Sure, some would believe that the e-commerce train would lose momentum post-pandemic. But, SHOP stock is currently looking at gains of over 35% year-to-date now. Could this mean that it has more room to run moving forward?

For one thing, Shopify does not seem to be slowing down anytime soon on the operational front. Earlier in June, the company provided investors with a massive update. Notably, Shopify is planning to extend its one-click checkout service, Shop Pay, to all U.S. merchants on Facebook (NASDAQ: FB) and Google (NASDAQ: GOOGL). For starters, this move is a rather strategic play by the company, to say the least. By collaborating with these tech giants, the company would be extending its market reach significantly. Also, this would mark the first Shopify product being offered to non-Shopify merchants, possibly diversifying its streams of revenue.

By and large, Shopify appears to be making the most of its pandemic-fueled growth right now. Judging from its 110% revenue growth in its first quarter, investors may be hoping that this momentum could continue throughout 2021. Of course, no one can be sure if the e-commerce industry can maintain its current momentum. But Shopify’s strategic partnerships could be why investors are excited about the stock right now. Could all this make SHOP stock a top tech stock to buy for you now?

Read More

Upstart

Upstart is a growing online leading platform that utilizes artificial intelligence to automate the lending process. So, what makes the company tick? Many banks love partnering with Upstart because the company builds loan products for them and offers quotes within its own site on behalf of banks. This way, it helps banks reduce the risk and costs of lending, and potentially increase the volume of loans. With the company’s platform, banks can provide personal loans using non-traditional variables like education and employment to predict creditworthiness. Upstart’s platform uses sophisticated machine learning models to more accurately identify risk and approve more applicants than traditional credit-score-based lending models.

The lending technology company has also expanded into auto loans. Earlier this year, Upstart acquired Prodigy Software. Prodigy is a provider of cloud-based automotive retail software which some describe as Shopify for auto dealers. Additionally, Upstart also expanded its partnership with Customers Bank, a full-service community bank and subsidiary of Customers Bancorp (NYSE: CUBI). This extended partnership would include scaling its personal loan program through the Upstart Referral Network and Customers Bank’s own consumer banking website. Customers Bank’s partnership with Upstart has helped it grow its loan portfolio over the past few years, and it expects that trend to continue.

What’s more impressive is that the company has already achieved profitability. Upstart reported a net profit of $6 million in 2020, making it one of the few profitable fintech companies. That said, an investment in Upstart stock could prove to be extremely rewarding. With more predictive underwriting models and lower fraud rates delivered by the platform, the potential for Upstart to keep growing is enormous. Of course, Upstart needs to grow its customer base to keep growing. Should the company be able to build on its current fundamentals, investors might want to take a closer look at UPST stock.

[Read More] Best Stocks For Inflation In 2021? 4 Real Estate Stocks To Watch

SEMrush Holdings

SEMrush is a software-as-a-service (SaaS) business directed at online marketers. The company started in 2008 as a single-point solution for search engine marketing. It has since expanded into a wide array of marketing services. It’s true that SEMrush IPO was not particularly well-received. However, shares have moved slightly higher since. SEMR stock is showing bullish signs this week, with the stock closing 4.6% higher on Tuesday’s trading.

So, what does the company actually do? SEMrush provides a SaaS platform that helps companies improve their online marketing efforts. Essentially, it is a ‘one-stop-shop for search engine marketing with more than 50 tools. As comprehensive as the service may sound, no investment comes without risk. And when it comes to an investment in SEMR stock, the key thing to watch is the competition. It’s no secret that a number of other companies, including Big Tech companies, offer online marketing services. Therefore, SEMrush will need to maintain its current competitiveness, in the long run, to stay as one of the best providers in the space.

From its first-quarter results, the company’s revenue came in 44% higher year-over-year to $40 million, while net income was $1.5 million. This is a huge improvement considering the company recorded a loss of $1.9 million in the prior-year period. Just as impressive, the company recorded dollar-based net revenue retention of 116%. More importantly, the company kept adding services that its core clients wanted. If anything, it is apparent that the company went from being a point solution to a full-fledged platform. With a fast-growing market like this, I’m excited to see how SEMR stock would unfold in the coming years.