Coming off a solid 2020, the electronics payment giant is poised for a bright future.

Entrepreneur’s New Year’s Guide

Let the business resources in our guide inspire you and help you achieve your goals in 2021.

February 2, 2021 4 min read

This story originally appeared on Market Beat

PayPal (NASDAQ: PYPL) was one of the biggest pandemic winners in the market in 2020. The electronic payments giant added 21.3 million net active accounts during Q2 2020—its best result ever. It followed that up by adding 15.2 million net active accounts in Q3—its second-best result ever.

PayPal’s total payment volume (TPV) growth has accelerated over the last three quarters; it was 18 percent yoy in Q1, 28 percent yoy in Q2, and 36 percent yoy in Q3. That TPV acceleration may come to an end in Q4, however, as PayPal said to expect Q4 TPV growth in the low-to-mid 30 perfect range in its Q3 earnings release.

In addition to the soft Q4 outlook, PayPal didn’t issue 2021 guidance. Management said that it would provide its “thoughts for 2021” in February when PayPal releases its full-year results. Well, that time is almost here as PayPal is set to report tomorrow.

2020 looks like a tough act to follow, and growth rates are likely to slow down in 2021. But maybe not by much.

Related: What’s Next for PayPal After Integrating Cryptocurrencies?

Still innovating

“If it ain’t broke, don’t fix it” applies to a lot of situations. But it doesn’t apply to running an electronic payments company with a market cap of more than a quarter of a trillion dollars.

PayPal has innovated its way to the top of its industry, and if it stops innovating, its competitors will crush it. Fortunately for PayPal investors, the company isn’t resting on its laurels.

The company is starting to allow users to buy and sell cryptocurrency directly from their PayPal accounts. Bitcoin has been on fire over the last few months; PayPal’s new crypto options will attract new users and increase activity for existing users. That’s a will not a should because we’re already seeing this story play out with Square (NYSE: SQ); Bitcoin is helping Square’s Cash App reach new heights.

In 2020, PayPal launched in-store payments via QR code, which supports contactless transactions. Yes, the pandemic is (hopefully) almost over but contactless payments aren’t going anywhere. People are increasingly cognizant of communicable diseases, and not handling cash or credit cards takes away a couple of transmission possibilities. Plus, it’s nice not to have to carry around cash or cards.

PayPal’s “Pay in 4” installment credit option is another recent innovation. It’s not the only company that is offering such an option, but PayPal’s offering enjoys several advantages over those of its competitors.

Venmo growth could accelerate

Venmo’s TPV was up 61 percent yoy to $44.3 billion in Q3 and the platform has 65 million users. Those numbers are even more impressive when you consider that one of Venmo’s main use cases is the sharing of dinner and bar tabs.

In the second half of 2021 and 2022, people are likely to go out with friends more than ever. Which would result in more dinner and bar tabs to split. Venmo’s TPV could explode.

Wall Street sees upside

On Wednesday morning, three Wall Street firms released notes on PayPal:

- Bernstein reinstated coverage with an outperform rating and $297 price target.

- Morgan Stanley (NYSE: MS) adjusted its price target from $229 to $297.

- KeyBanc boosted its price target from $235 to $300.

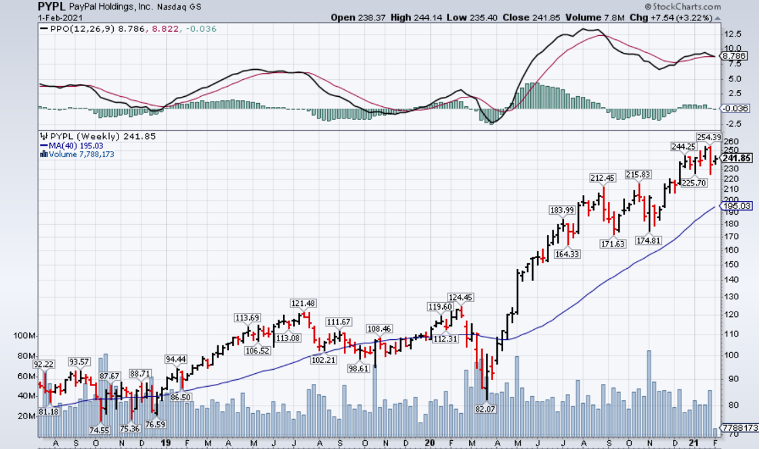

PayPal has more than doubled over the last year and is trading near all-time highs, but the analysts still think that shares have more room to run.

How should you play PayPal?

PayPal is trading at 11.2x forward sales and 53.3x forward earnings, but the company could see strong top and bottom-line growth for many years to come. Many of the greatest investments have been industry leaders in growing industries. PayPal is exactly that. And it’s not as if you’re paying some crazy multiple.

That said, an investment in PayPal requires a tough stomach. There has been a lot of volatility over the last few months – a combination of profit-taking and news-driven moves – and that may continue for the foreseeable future. If you are able to buy-and-hold PayPal, however, the long-term rewards should be worth the short-term volatility.