Digital advertising boom provides a nice set-up for these advertising stocks to thrive.

Free Book Preview

Money-Smart Solopreneur

This book gives you the essential guide for easy-to-follow tips and strategies to create more financial success.

May

11, 2021

6 min read

This story originally appeared on StockMarket

Are These The Best Advertising Stocks To Buy Now?

The stock market has taken another beating this week. One particular sector taking a big hit is advertising stocks. This came even after their recent strong earnings report. For instance, The Trade Desk (NASDAQ: TTD) saw its stock tumbling more than 25% on Monday after the company reported earnings and a 10-for-1 stock split. From a first glance, it looks like a bad quarter sent TTD stock crashing. But that’s not the case.

In fact, the company’s performance wasn’t that bad, just not good enough. This may not be surprising as high expectations were baked into the stock due to an accelerating momentum of ad-tech technology. From its quarterly earnings report, revenue came in 37% higher to $219.8 million, beating Wall Street’s estimates of $216.9 million. It’s also worth noting that the customer retention rate remained strong, continuing a seven-year streak of retention rates above 95%. If anything, this is a strong validation of the company’s offering to its clients.

These advertising companies are also likely to thrive in strong economies as businesses would have the incentives to snatch back more customers. The digital advertising industry is already coming into 2021 with strong momentum, having seen sales ramp up in the second half of last year in spite of pandemic-related headwinds. Now, with the pullback of TTD stock, some of the top advertising stocks are not spared either. In light of the recent market correction, would now be a good time to bet on these top advertising stocks in the stock market today?

Top Advertising Stocks To Watch Right Now

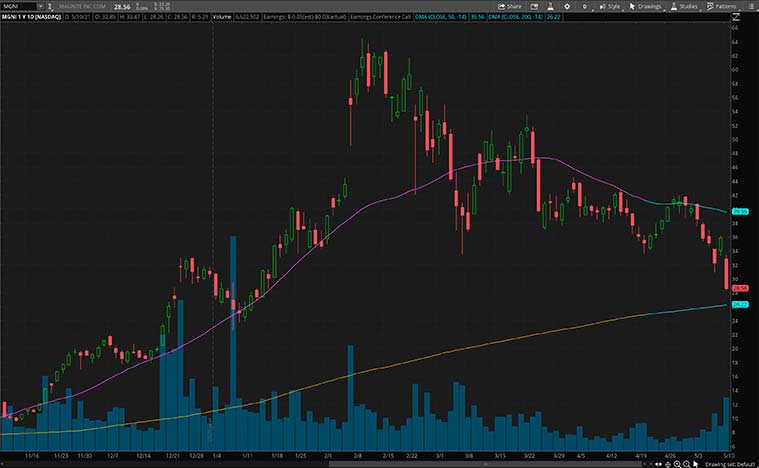

Magnite

Magnite is the world’s largest independent omnichannel sell-side advertising platform. On Monday, the company reported its first-quarter earnings, where revenue came in 67% higher year-over-year to $60.7 million. With the recent acquisition of SpotX for $1.17 billion from RTL Group, Magnite is turning into a capital ad tech firm that has a hold on every major cable network and streaming channel. The merger also strengthens the company by creating a cost-saving synergy of $35 million annually. That in turn fortifies Magnite’s position in the ad-based streaming vertical.

While all these seem like positive developments for investors to bank on MGNI stocks, the company saw its stock fall in sympathy with the sell-off of TTD stock. Admittedly, ad-tech companies may not exactly be front-end with direct relationships with users, Magnite is definitely pulling the right strings behind the scenes. So long as Magnite continues to tap into multiple different CTVs and streaming channels, it continues to grow its revenue potential. With all that said, will the recent pullback in MGNI stock be a good opportunity for you to scoop up its stock at a discount?

[Read More] Top Stocks To Watch This Week? 4 Tech Stocks In Focus

PubMatic

PubMatic is a tech company that develops and implements advertising software and strategies for the digital publishing and advertising industry. The company’s cloud infrastructure platform is used for digital advertising, empowering app developers and publishers to increase monetization. It also enables media buyers to drive return on investment by reaching their target audiences. PubMatic is not spared from the sell-off in TTD stocks either. The company saw its stock traded around 17% lower on Monday. Nevertheless, since the start of the year, PUBM stock is still up by over 30%.

The company reported its fourth-quarter financials in February, much to investors’ delight. In it, the company reported a revenue of $56.2 million, a 64% increase year-over-year. Net income for the quarter was $18.8 million. The company also ended the quarter with $101 million in cash. These impressive financials are likely due to PubMatic’s differentiated market position across the digital advertising ecosystem. The company is currently in the midst of an accelerated digital transformation as more consumers are spending more time online. With that in mind, will you consider PUBM stock as a top advertising stock to buy ahead of its earnings release on May 13?

Read More

Roku

One of the most prominent names in the advertising industry now would be Roku. For the uninitiated, the company facilitates content from most mainstream video streaming services. Subsequently, Roku receives a cut of subscription fees paid through its platform while also gaining ad revenue from its free content. All this would strategically position Roku to grow regardless of which streaming company comes out on top. It is no secret that ROKU stock has been performing relatively well for the past year. It is seeing gains of over 120% in this period.

From its first-quarter report, revenues came in 79% higher from the year-ago quarter to $574.2 million. Furthermore, usage was strong, as it added 2.4 million accounts in the quarter. That increased the number of accounts on the platform by 35% year-over-year. Considering the company’s profitability profile, is ROKU stock a top advertising stock to buy now at its current valuation?

[Read More] Best Stocks To Invest In Right Now? 4 Cybersecurity Stocks To Consider

As one of the leading social media players on the market, FB stock has been in the limelight over the past year. It has surged by over 100% since the stock market crashed in March 2020. From its most recent quarterly report, Facebook’s earnings came in at $3.3 per share, topping analysts’ estimates of $2.37. Revenue came in 48% higher to $26.17 billion. The social media giant attributed the significant increase in revenue to a 30% year-over-year increase in the average price per ad and a 12% increase in the number of ads delivered.

Another key metric to note when it comes to social media companies would be daily active users (DAUs). Well, Facebook showed an average of 1.88 billion DAUs in its platform from its most recent report. Moving forward, the company cited growing e-commerce trends and shifting consumer demands as key drivers for its current momentum. Accordingly, these provided a tailwind for Facebook’s advertising business and marketplace. It is safe to assume that Facebook’s dominance in the social media space is here to stay for the foreseeable future. Given its massive influence, would you include FB stock on your list of best advertising stocks to buy right now?