June

13, 2021

7 min read

This story originally appeared on PennyStocks

4 Penny Stocks To Watch This Week With Upcoming Events

Penny stocks can be fickle. On the one hand, many will move with different market trends. On the other hand, they may be completely disconnected from broader sentiment. This month, we’ve seen both of these instances, with everything from economic and earnings data pushing directional moves for small-cap stocks. Meanwhile, when the broader indexes like the S&P, Dow, and Nasdaq slid, the meme stock trend propelled certain penny stocks.

At the end of the day, it’s up to you as a trader to research and monitor trends. Heading into this week, there are definitely a few things to keep in mind. First, we’ve got another slew of economic data to digest. The latest focus has been on not if what to what degree of inflation will be in play.

[Read More] 4 Penny Stocks To Watch Hit It Big In 2021, 1 Up Over 2,200% Right Now

Monday’s quiet but Tuesday jump-starts the economic calendar with retail sales, the producer price index, industrial production, and business inventories. Housing data will follow on Wednesday, along with a press conference from Fed Chair Jerome Powell. Jobs data will be the topic of conversation on Thursday. Initial and continuing jobless claims and the Philly Fed manufacturing index figures get reported before the opening bell. This rounds out the week as Friday has no major economic data scheduled.

This isn’t the only thing to keep in mind, however. If you’re trading penny stocks, there’s also more than just a handful of companies set to report data and give presentations. In this article, we’ll check out some of the companies set to deliver info this week and the dates they will do so. In the end, I’ll leave it up to you to decide if these are the best penny stocks to have on your list this week or if they should be avoided entirely.

Penny Stocks To Buy [or avoid] This Week

1. Orphazyme (NASDAQ:ORPH) / CytRx Corporation (OTC: CYTR)

Denmark-based biopharma company Orphazyme was on top of mind late last week among retail trader discussions. Shares surged from $5.25 to highs of $77.77. The next day, the penny stock was trading around $9.30. This move came roughly a week ahead of an important FDA decision date in the week ahead. Orphazyme is collaborating with Cytrx Corp. in developing arimocolmol. The drug failed in clinical trials for amyotrophic lateral sclerosis and Niemann-Pick disease.

Orphazyme’s applications for arimoclomol for Niemann-Pick disease type C (NPC) are under priority review with the U.S. FDA, with an expected PDUFA action date of June 17, 2021. The European Medicines Agency, with an opinion from the Committee for Medicinal Products for Human Use, is expected later this year.

Read More

With Thursday as the date to keep in mind, it will be interesting to see how the market reacts to both ORPH stock and CYTR. CytRx Corp. previously sold arimoclomol to Orphazyme in exchange for milestone payments and royalties.

2. Mustang Bio Inc (NASDAQ:MBIO) / Fortress Biotech, Inc. (NASDAQ: FBIO)

Mustang Bio will be the main point of focus among these two companies this week. It was founded by Fortress, which tends to experience sympathy sentiment at times, in conjunction with some of its founding companies, including Mustang.

When it comes to the week ahead, Tuesday will be the day in focus. Mustang is set to host a key opinion leader webinar on its MB-106 CD20-targeted CAR T cell therapy. MB-106 is being developed for high-risk B-cell non-Hodgkin lymphomas and chronic lymphocytic leukemia. Tuesday, June 15, 2021 the company hosts this KOL webinar at 1:00 p.m. Eastern. While there are no guarantees of a positive outcome, we can look at recent data for reference.

Mustang recently announced that the U.S. FDA accepted its IND to begin a multicenter Phase 1/2 clinical trial of MB-106. It will investigate the treatment’s safety, tolerability, and efficacy in patients with relapsed or refractory B-NHL and CLL.

Penny Stocks To Buy [or avoid] #3: Matinas BioPharma Hldgs (NYSE:MTNB)

Matinas had a great end of the year last year, with MTNB stock surging from under $0.70 in September to over $2.20 by the start of 2021. However, since then, it’s been a downward spiral for most of this year. The last few weeks of May and into June showed some signs of recovery, though. The penny stock has bounced back from lows of $0.72 last month to highs last week of $0.88.

[Read More] 3 Innovative Penny Stocks to Watch This Summer If You Like Tech

Could it have something to do with the company’s upcoming event date? We’ll have to see this week. This Thursday, June 17th, Matinas hosts virtual R&D Day to highlight its lipid nanocrystal (LNC) delivery platform and related programs.

“We are excited by the opportunities ahead for our LNC platform and associated drug candidates and have made meaningful progress since the beginning of 2021,” commented Jerome D. Jabbour, Chief Executive Officer of Matinas, in a May 10th PR. “Specifically, we continue to advance MAT2203 in cryptococcal meningitis through Cohort 2 of the EnACT trial towards its next DSMB review, which is anticipated in the third quarter of 2021.”

What’s more, the company has been focused on expanding the application of the LNC platform with its collaborations with Genentech. It’s also expanding the application with the National Institutes of Allergy and Infectious Disease in creating an oral formulation of Gilead’s (NASDAQ: GILD) remdesivir. So if MTNB stock is on your list this week, keep June 17th in mind.

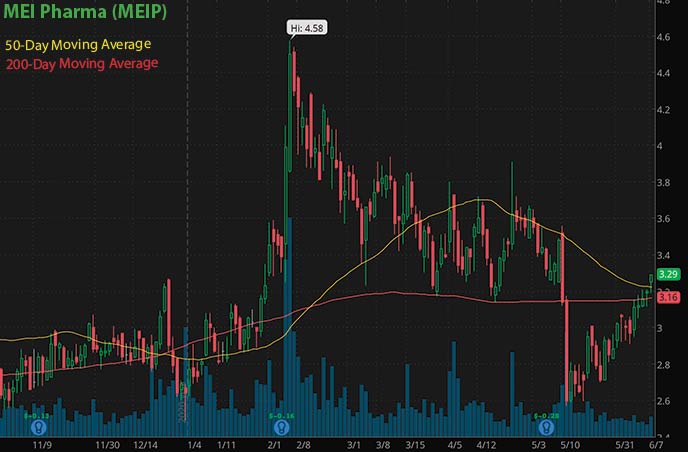

4. MEI Pharma, Inc. (NASDAQ:MEIP)

Like MTNB, MEIP stock kicked off the year on a high note, but it’s been a general downward trend over the last few months. That is, until mid-May when MEI Pharma stock began rebounding. Granted, it came after two huge days of selling off. Needless to say, MEIP has managed to bounce back by nearly 30%.

This week, MEI could be a focus for some traders as the company. clinical data from a Phase 1b study of zandelisib in clinical development for the treatment of B-cell malignancies, and the trial design of COASTAL, a Phase 3 study of zandelisib combined with rituximab. It will be highlighted in poster presentations at the International Conference on Malignant Lymphoma being held June 18 – 22, 2021.

These findings will be posted in collaboration with Kyowa Kirin Co., Ltd. It’s a global specialty pharmaceutical company discovering and delivering novel medicines. This comes about a week after the company’s presentation at the American Society of Clinical Oncology (ASCO) Annual Meeting.

“We are encouraged by the zandelisib data being shared at this year’s ASCO Annual Meeting, specifically the data that showed zandelisib activity across differing patient groups, including POD24 – a group that typically has a poor prognosis and would generally be expected to meet the inclusion criteria of our Phase 3 COASTAL study,” said Richard Ghalie, M.D., chief medical officer at MEI Pharma in response to the ASCO data.

Should You Buy Penny Stocks?

Trading & investing, like many things, are risky endeavors. But they aren’t out of reach, even for the “average” person. With the surge of new traders jumping into the market over the last year, a few things have set successful traders apart from the unsuccessful. One of the most important things is education.

Knowing how to actually buy and sell stocks, research different fundamental factors, then use them to your advantage are key. Are penny stocks worth it, and should you buy them? That is completely up to you. But what I will say is with the right education and general understanding of how to use trends to your advantage, they are one of the best ways to profit from quick moves in the stock market daily.