February 4, 2021 15 min read

Opinions expressed by Entrepreneur contributors are their own.

For the average small-business owner, it’s hard enough to understand how to get a piece of the latest round of Paycheck Protection Program (PPP) money, let alone how to access the Employee Retention Tax Credit (ERTC or “Credit”).

In fact, under the CARES Act (the first round of relief signed into law in March of last year), employers were not allowed to obtain both a PPP loan and claim the Credit. Thus, most small-business owners gave up on even learning about or considering the ERTC.

However, under this second round of overall coronavirus aid, business owners are able to get aid from BOTH provisions. Yes, you can tap into the PPP and claim the ERTC!

Thus, the ERTC is a critical provision in the massive 5,500-plus-page Consolidated Appropriations Act of 2020 for small-business owners to understand and possibly utilize.

Which companies qualify?

- Any sole proprietor, limited liability company (LLC), S-Corporation or C-Corporation is eligible, if they meet the additional criteria to qualify.

- Any company with less than 500 employees (Full-Time Equivalent employees, FTE) as of December 2020 may participate in the program and apply for the ERTC. (Previously, only business owners with less 100 employees could participate.)

- In order to claim the Credit, a business must have experienced a decline in gross receipts by more than 20% in any quarter of 2020, compared to the same quarter in 2019.

The following Diagram illustrates the five steps to compare and calculate if you qualify:

How much is the Credit?

- The credit is 70% of Qualified Wages for the allowed amount, per quarter, paid between January 1, 2021 and before July 1, 2021.

- Each employee’s allowable wage amount is $10,000 per quarter in 2021, excluding any owner and their family member’s payroll with combined ownership in the company of 50% or more (more on this below).

- So, the maximum any employer may receive as a credit per un-related employee in 2021 is $14,000 ($7,000 per quarter). (This does not take into account coordinating this credit with PPP. More on that below.)

- But also, don’t forget about qualified wages paid between March 13 and Dec 31, 2020! The credit is 50% of qualified wages paid during this period, but only up to $10,000 per employee of annual wages paid (more on this below, along with the rules regarding owners and their family members’ payroll amounts).

- Thus, the maximum any employer may receive as a credit per employee in 2020 is $5,000. (More below on the possibility of going back and getting the credit for 2020.)

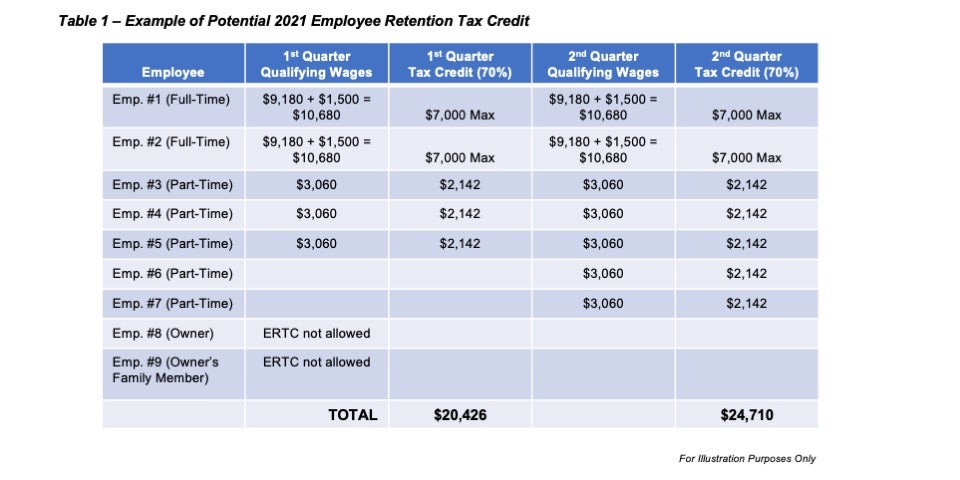

Example: XYZ Enterprises, LLC (taxed as an S-Corporation) plans to have two full-time employees in 2021 that will each be paid $9,180 ($18 an hour) during first and second quarter of 2021, including three part-time employees in the first quarter and five part-time employees in the second quarter that will each be paid $3,060 ($12 an hour) a quarter. The Corp will pay health-insurance premiums for the two full-time employees, pre-tax, of $500 per month, or $3,000 per quarter for both of them combined. Thus, total Qualifying Wages of the employees and the calculation for the ERTC is set forth below in Table 1 as follows:

* More below on how this amount works in conjunction with the PPP, and if an employer can go back to 2020.

What payroll is considered Qualifying Wages for the ERTC?

Qualifying Wages is a critical term to understand, in addition to what it includes when calculating the ERTC. It’s more than just gross pay. First, Qualifying Wages includes both full-time and part-time employees’ payroll amounts.

Next, you are allowed to add any qualified health plan expenses/premiums you paid on behalf of the employee to this figure. This generally includes both the portion of the health-insurance cost paid by the employer and the portion of the cost paid by the employee with pre-tax salary-reduction contributions.

However, the qualified health plan expenses do not include amounts that the employee paid for with after-tax contributions. More here at the IRS website on how to determine and calculate Qualifying Wages.

Can you the Owner get the Credit for your personal payroll or profit?

This is the golden question, isn’t it? Regrettably, the answer is somewhat in a gray area. All we know regarding this particular detail comes from the IRS.gov Newsroom and the FAQ section regarding the ERTC.

For sole proprietors, the answer is no. The IRS in FAQ #23 makes it clear that they are not going to allow the ERTC for sole proprietors under their interpretation of the CARES Act. They also clearly state that the FAQ section has not been updated under the Taxpayer Certainty and Disaster Tax Relief Act of 2020, enacted December 27, 2020. Most professionals agree that the new legislation doesn’t change the rule for sole proprietors.

However, FAQ #23 does not address corporations, or more specifically, S-Corporation owners. In fact, FAQ #59 states that S-Corporations are allowed to take the ERTC for their employees (assuming the business owner complies with all the other rules, including not claiming payroll for the ERTC that was covered with PPP money).

FAQ #59 further states that payroll for “related individuals” of the S-Corporation owners cannot be used for calculating the ERTC. However, it conspicuously does not state that the “owner” is considered a related individual.

So, when it comes to the action owners of S-Corporations holding 50% or more of the stock, the safe bet is to consider them a “related individual,” and thus the owner cannot receive the ERTC on their own payroll. This cautious interpretation would fall in line with other rules in the code regarding self-dealing or prohibited transactions (i.e. Section 1372 of the Internal Revenue Code requires that 2% or greater shareholders be treated as partners in a partnership for this purpose, making them self-employed individuals instead of employees).

Thus, for purposes of this article and the advice we are giving our clients, until we see definitive guidance and a stance from the IRC on the issue of payroll for owners of an S-Corporation owning 50% or more of the entity, we would not claim the ERTC on their wages.

But what we do know, according to IRS FAQ #59, any and all payroll for a “related individual” cannot be used in determining the allowable ERTC in 2020 or 2021. These individuals include any of the following with a relationship to an owner of the company who owns 50% or more in value of the outstanding stock:

- A child or a descendant of a child;

- A brother, sister, stepbrother, or stepsister;

- The father or mother, or an ancestor of either;

- A stepfather or stepmother;

- A niece or nephew;

- An aunt or uncle;

- A son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law or sister-in-law.

In summary, if you aren’t employing a third-party unrelated to you personally, it would be advisable not to try and claim the ERTC, even if you meet all of the other qualifications.

What happens if my company had a recovery later in 2020 or 2021?

Finally, be aware that if your company actually had a significant business recovery before the end of the 2020 or has one in 2021, your eligibility for the ERTC may end.

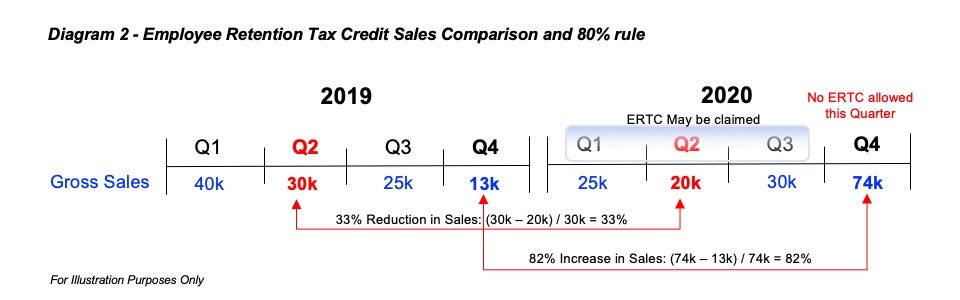

Under the new Covid law, a business owner is no longer allowed to take the ERTC in the quarter immediately following a quarter where their quarter gross receipts exceed 80% compared to the same calendar quarter the year before.

For example: If a business has a 2020 second quarter where revenue is down 33% compared to the same quarter in 2019, the business qualifies for the ERTC in first and second quarter of 2020 and would continue to qualify for the rest of the year. However, in fourth quarter, revenue in the business is up by 82% compared to the same quarter in 2019. At this point, the company no longer qualifies for the ERTC in fourth quarter 2020. In fact, the company only qualifies up to the point where sales increased above the 80% threshold and is limited to claiming the ERTC for qualified wages in first, second and third quarter 2020. See the following illustration Diagram 3.

Additionally, this same rule applies into the first and second quarter of 2021. Thus, if you have a dramatic upturn in sales (80% rule) in second quarter 2021 compared to second quarter 2020, then your eligibility for the ERTC would end with first quarter 2021.

How does the ERTC work with PPP?

The good news is (and it’s significan), under the new legislation, business owners are entitled to both the first and second round of PPP and the ERTC. However, PPP funds and ERTC cannot be used to cover the same payroll costs. But all is not lost; it just gets tricky.

If a business owner plans carefully and does good record keeping and accounting, they should be able to maximize the benefits of both PPP and ERTC, creating thousands of dollars in tax-free money!

First, let’s assume a business owner qualifies for the second round of PPP under the new 25%-reduction-in-sales rule.

Next, since the threshold to qualify for the ERTC is lower than that of the PPP (a 20% rule), it’s then obvious the business owner would thus qualify for both.

NOTE: Stated otherwise, if a business owner qualifies for PPP under the sales comparison test, then they automatically qualify for the ERTC. They also need to then “coordinate” the two benefits in taking advantage of them both to the greatest extent possible.

In order to exploit both benefits, it’s important the business owner take into account the following points and then a three-step strategy:

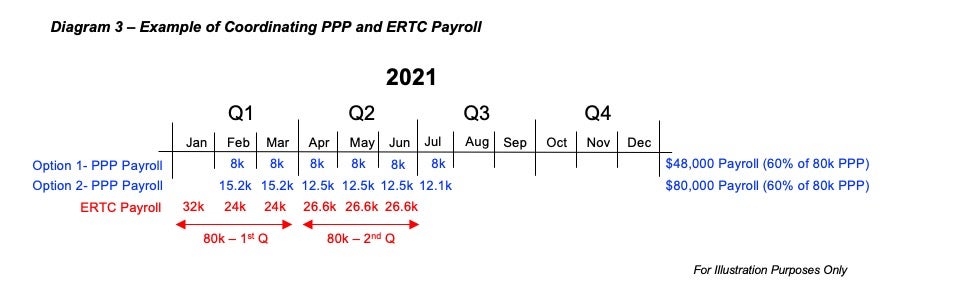

- The application deadline for the latest round of PPP is March 31, 2021. (It might behoove a business owner to delay applying for PPP up until the deadline in order to maximize their ERTC benefit.)

- Remember, 40% of PPP monies can be used for items other than payroll, such as mortgage interest, rent, utilities, worker protection costs related to Covid-19, uninsured property damage costs caused by looting or vandalism during 2020 and certain supplier costs and expenses for operations. (Thus, it’s critical to use no more than the 60% of PPP money for payroll since those payroll dollars can’t be used for the ERTC).

- Next, PPP money must be spent on payroll and qualified expenses over 24 weeks from the day the disbursement is received. This is referred to as the ‘”Covered Period.” (A business owner will more than likely want to use every week of this period rather than spend the PPP money quickly, in order to get the most out of the ERTC.)

- Finally, keep in mind that the ERTC is up to 70% of $10,000 of qualified wages paid to each employee in each of first and second quarter 2021 only — not in third or fourth quarter. (However, PPP money can be spent in third and fourth quarter because of the 24-week period.)

Strategy:

- The business owner should only used 60% of their PPP funds for payroll (if possible) and the rest on qualified expenses.

- Next, they should spread out the PPP money used for payroll as long as possible (within the 24-week period), and if they haven’t already applied for the PPP, maybe wait until the end of March, but not miss the application deadline.

- Then, the business owner should max out the ERTC credit in the first and second quarter with payroll expenses not used with PPP money.

Here is an example to illustrate how this strategy could potentially be used.

For example: Assume a business owner (not in the accommodation or food service industry) qualifies for both the second round of PPP and the ERTC. They receive $80,000 in PPP funds on February 1, 2021. Presumably, since they received $80,000 in PPP funds, their average monthly payroll would have been $32,000 ($80,000/2.5). Their 24-week Covered Period would also then be from February 1–July 19, 2021. Further, we want to assume that the business owner has the ability to spend 40% of their PPP money on other expenses than payroll. This would require that only $48,000 (of the $80,000) must be spent on payroll over the 24-week period. Thus, the business needs to spend approximately $8,000 a month on payroll out of the PPP money over that period. If it can meet this minimum, then the entire PPP loan should be forgiven. Finally, we need to know the number of employees and their expected payroll over the time period they are eligible for the ERTC and need to spend the PPP money. See the table of employees below (Table #2) and the diagram of allocating payroll during the time periods (Diagram #3).

I think it’s important to recognize that placing any PPP monies received into a separate bank account and carefully tracking what expenses they are used for is absolutely critical to staying out of hot water in a potential audit.

Also, one last nuance to keep in mind when coordinating the payroll expenses for PPP and the ERTC: Qualified Wages include payroll costs for group health-care benefits paid pre-tax by employees, such as the employee share of their health-care premium. Moreover, ERTC guidelines do not prohibit including in Qualified Wages expenses accelerated for group health benefits paid in first or second quarter. These are different rules compared to the PPP program and need to be taken into account when calculating which payroll costs for the ERTC and which ones are paid for with PPP money.

Can a business owner go back and claim the ERTC for 2020 if they didn’t already do so?

Yes. Assuming a business owner meets the 20%-reduction-in-sales rule for any quarter in 2019 compared to the same quarter in 2020, the business can claim the ERTC for 2020 and the first two quarters in 2021.

However, the ERTC is worth different amounts for 2020 and the first two quarters of 2021. For wages paid after March 12, 2020, and before January 1, 2021, the ERTC can be applied to 50% of qualifying wages up to $10,000. This means a maximum of $5,000 per employee could be credited back to your company if it qualifies.

How do I receive this credit?

Let me first start by stating what you don’t do to get this credit:

- You don’t apply through your bank.

- It has nothing to do with your PPP application process.

- You don’t apply through the Small Business Administration (SBA).

- You don’t even send the IRS a specific application for the ERTC (unless requesting an advance).

The ERTC is a refundable tax credit that is typically claimed when eligible employers report their total qualified wages for purposes of the ERTC for each calendar quarter on their federal employment tax returns (Form 941: Employer’s Quarterly Federal Tax Return).

However, employers that want to reduce their payroll deposits in anticipation of receiving the credit, or want to receive a payment in advance from the IRS, may submit a Form 7200. This means potentially having the ability to get the tax credit back early in the form of a check from the IRS.

The IRS has a dedicated web page, “How to claim the Employee Retention Credit FAQs,” explaining how and when to file certain forms. Nonetheless, it’s advisable you speak with your tax advisor or payroll company to make sure you coordinate the application and payments, especially if you also plan on utilizing PPP funds.

Presumably, if a business is going to go back and claim the ERTC for 2020, it would need to first determine which payroll was paid for with PPP funds and then calculate which qualifying wages would be eligible.

Next, the business owner would go back and amend the appropriate quarterly Form 941s for 2020 and claim the credit. However, the IRS has not given specific guidance on this procedure.

Related: The IRS Increases 2021 Contribution Limits to SEP IRAs and Solo 401(k)s for Business Owners

In summary, the ERTC is an opportunity for business owners with W-2 wages for employees to obtain some significant help from the government. A business owner should carefully determine if they qualify and seek out professional guidance from their tax return preparer and/or payroll company to make sure the proper forms are filed. Be careful to not leave any money on the table under this new legislation if you can help it. Get involved in the process. You are the captain of your ship!

Mark J. Kohler is a CPA, Attorney, co-host of the Podcast MainStreet Business and author of the The Tax and Legal Playbook- Game Changing Solutions For Your Small Business Questions, 2nd Edition, and The Business Owner’s Guide to Financial Freedom: What Wall Street isn’t Telling You. He is also a partner at the law firm Kyler Kohler Ostermiller & Sorensen, LLP and the accounting firm K&E CPAs, LLP.