Opinions expressed by Entrepreneur contributors are their own.

What is the best place to save? This is the most frequently asked question and also the hardest to answer. It’s like a stranger talking to you on the phone and asking you what to wear. You would need to know what size his body is, his complexion, age, for what occasion he wants the dress and, above all, his tastes.

The investment issue is complex because it has to do with the time you want to leave the money working, your tolerance for risk, the knowledge you have about certain financial instruments and especially your objectives.

The first thing you must determine is what you want to invest your money for because this will respond to three fundamental points for decision making: performance, security and liquidity. Here we will leave you some points that you should pay attention to in order to choose where to invest .

1. Performance

There is a rule of thumb when it comes to returns that we should never overlook: the higher you promise, the more risk there is. There is no investment with zero risks. If your performance is high you have to give up either in the time that you will not be able to touch the money or in security. Performance should not necessarily be the most important factor in making decisions, because you are not always interested in the money growing, sometimes other things may be of more interest, such as the ones we will see below.

2. Security

Not all investment projects have the same degree of security. This is largely determined by who regulates the institution where you are going to invest. For example, if you have your money saved in a bank, it is protected by up to 400,000 UDIs . This means that if the bank goes bankrupt and you have less than that amount saved, your entire savings will be returned to you. On the other hand, it is an institution that is not regulated and ends up disappearing, there is no instance that can return the money and you only have to file a civil lawsuit. So if they offer you some kind of investment, always ask who supervises it and if it is not regulated then ask yourself if you are willing to take that risk.

3. Liquidity

The investment horizon is basically the time that you are not going to move the money that you are going to save. In effect, in an investment you must not be able to withdraw the capital you inject. For example, if you have a business and buy a computer, you cannot make this money liquid. If you buy some type of bond or purchase insurance with investment, the money will not move for a long time.

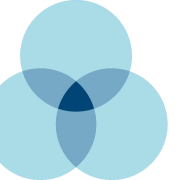

It would be best to have all three points working at the same time, unfortunately this is not possible. You will have to choose one or in the best of scenarios, two when choosing your investment vehicle. That is why in any strategy it is so important to diversify, because, since you cannot have the perfect financial product, you must add different tools to generate the best scenario. In fact, scams are present when they offer you all three features at the same time.

These are some of the combinations you can find:

Banks

Your money is safe, it is available, but it does not give you returns. Check in your Google search engine the actual Total Annual Profit (GAT) of the bank of your choice. You will see that the vast majority of returns are negative. That is why a bank is to make transactions, but not the best place to save and much less invest.

Personal Retirement Plan

In these platforms your money is safe, it gives you returns, but the capital is not available. Either with an insurer or in Afore your money is safe because they are highly regulated and give you high returns if you make it tax deductible. In fact, this is one of the instruments with the highest yield for the taxes that you stop paying and the lowest risk there is. Where do you give in? In the time. The money cannot come out until you turn 65 and if you take it out earlier you will have a series of penalties, including the taxes that you did not pay.

Invest in the Stock Market

It has good dividends, but the higher returns you seek, the longer should be the time that you do not take out the capital.

The Flower of Abundance

This unregulated “tool” gave very high returns in a very short period of time, but there was a very high risk of losing your money. The National Commission for the Protection and Defense of Users of Financial Services ( Condusef ) has warned since 2015 of the risks that this form of fraud brings with it.

As you will see, there is no perfect financial instrument, everything must go according to your strategy of what you want to achieve, in how long and, above all, how much risk you are willing to take. So do not be guided by the star product, but define your investment plan well before injecting your capital.